Bank Statement Loans 2024

Bank statement loans were created for self employed individuals who cannot document their income using tax returns. Borrowers can qualify for a mortgage using bank statements detailing average monthly deposits as a basis to determine their income.

Getting approved for a mortgage is much easier for self employed borrowers now that bank statement loans are available in 2024. We will walk you through everything you need to know about bank statement loans and then connect you with a bank statement mortgage lender.

See if you qualify and to check on bank statement mortgage rates

What is a Bank Statement Loan?

A bank statement loan is a creative loan program which requires borrowers to provide the last 12 months bank statements instead of tax returns. Lenders will use a percentage of the average monthly deposits as the monthly income on the loan application to qualify for the mortgage. Bank statement loans are the most common mortgage used by self employed borrowers today.

In the past, self employed borrowers were able to find stated income loans or no doc loans easily. However, after the mortgage crisis in 2008, these mortgage programs to help self employed borrowers disappeared. They had to qualify on their net income referenced on the tax returns . When taking all of the legal tax deductions into consideration, it became nearly impossible to qualify for a mortgage.

Now, bank statement loans for self employed are here and they are a safer and more realistic loan program that is good for both the borrowers and the lenders. This is great news for self employed individuals who are looking to finance their dream home.

Bank Statement Loan Program Information

With a bank statement loan you are going to qualify based upon the 12-24 month bank deposits (depending upon the lender) into your personal and/or business accounts. The bank statement lenders want to see a consistent flow of money sufficient to qualify you for the bank statement mortgage.

Advantages of Bank Statement Loans

- Bank statement loans for self employed help business owners and 1099 contractors to qualify for a mortgage

- Bank statement lenders allow you to qualify by supplying them with your bank statements only

- Mortgage rates are only slightly higher than conventional loans

- LTV up to 90%

- DTI up to 50%

- Low credit scores are permitted

- Recent bankruptcy or foreclosures are permitted

- NO PMI or Mortgage Insurance

- Very competitive rates

Bank Statement Loan Pros and Cons

Pros

- Helps self employed borrowers to qualify for a mortgage without using tax returns to prove income

- Can be done in some instances with only 10% down

- Bank statement mortgage rates are just slightly higher than conventional rates

- Up to 50% DTI – Debt to income depending upon your scenario and lender

- Typically no pre-payment penalties

- Available in all 50 states

Cons

- You need to be self employed for a minimum of 2 years

- If your credit score is extremely low, it may result in a higher down payment

- Rates are slightly higher than conventional but not much more

- Not all lenders offer bank statement loans

- Not available in government loans such as FHA, VA or USDA

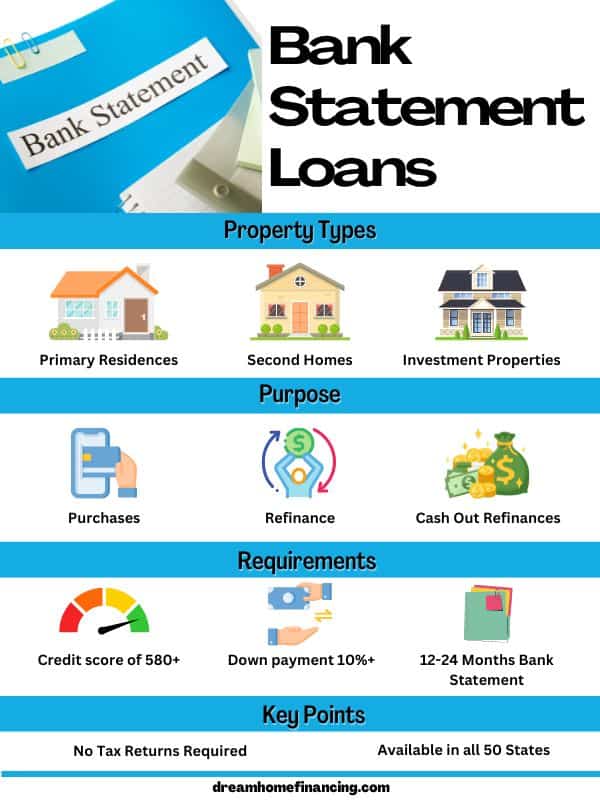

Bank Statement Loan Requirements

You must be self employed – which means you have to prove it by providing a letter from your accountant verifying that you have been in business for at least two years. You may also have to provide a business license if applicable. The bank statement lender may also accept a business listing, website address, etc.

A non-self employed co-borrower (someone with W2 earnings) may also be added to the loan as well as their income. There is no way around the self employed requirement but 1099 borrowers can qualify as well.

Down Payment – Some lenders may allow as little as 5% down but others will require up to 25% down. Sometimes, it is also determined by your credit score. If it drops below a particular threshold, then the lender may require a larger down payment.

It is critical to contact us early in the process to determine whether more is needed for your down payment. The good news is that gift funds from a relative are permitted and can be used towards the down payment.

Credit Scores – There are some bank statement lenders who offer programs for individuals with credit scores below 550 and maybe as low as a 500 FICO score. Keep in mind that your down payment requirement may increase and it is possible that your rate will as well.

We suggest speaking with a bank statement lender to find out what your personal scenario is.

Update September 2024 -All of the bank statement lenders have temporarily adjusted their guidelines. The minimum credit score today is 580. Down payment requirements have also been revised.

Bank Statement Home Loan Requirements – Most bank statement lenders require you to supply 12-24 months’ worth of bank statements to use as income verification. For personal bank accounts, they use 100% of the average. For business accounts, they will sometimes use 50% of the average. They will usually combine them both. The ability to use both business and personal accounts is a huge benefit.

Example

- Personal Account – 24 months’ deposits with a total of $150,000 deposited Divided by 24 = $6,250 monthly income

- Business Account – 24 month’s deposits with a total of $150,000 deposited Divided by 24 = $6,250 but will use 50% or $3,125 monthly income

*The bank statement lenders will take this income figure and will run it through their underwriting model to determine whether you qualify.

Assets – Your assets must be fully verified. This includes bank statements and any other assets that you would provide for a conventional loan. The more assets you can provide during the qualification process, the better chance you have to being approved for a bank statement loan. Additional assets also help those who have low credit scores.

Property Types – Single family primary residence, Second home, multi family, and investment

Find out now if you qualify and to get a Bank Statement Loan rate quote

Bank Statement Mortgage Lenders

Bank statement loans are not Fannie Mae, Freddie Mac, or government approved loans. The lenders who offer bank statement loans are taking on additional risk when originating these loans because the traditional qualification requirements required for a Fannie Mae approved loan are bypassed. They are solely using the funds deposited into the accounts as a basis for approval and not considering all of the expenses.

The lenders (often called portfolio lenders or Non-QM lenders) will keep these loans in their own portfolios or will sell them to investors. The appetite for the additional risk by both the lender and the investors often will have a significant impact on the down payment requirements and the rates.

These are just a few popular lenders who offer bank statement loans, but they are not necessarily the best or a good fit for your loan scenario. Some may also be mortgage wholesalers and do not lend directly to consumers but instead utilize a broker network.

- Carrington Wholesale Mortgage – Contact

- First National Bank of America – Contact

- ACC Mortgage – Contact

- Axos Bank – Contact

- Fund Loans – Contact

This is just a small sampling of the lenders who offer bank statement loans. The guidelines and requirements are changing often so let us help you to find the right lender for you

Complete this Request Quote Form to See if You Qualify

Bank Statement Loan Interest Rates

The bank statement mortgage rates are very competitive when you consider there is less documentation being provided to the lender. The rates will vary based upon your credit score, down payment amount, and whether you have a recent bankruptcy (or other credit event), and your average monthly bank deposits.

Bank statement mortgage loan rates will on average be at least 1-3% higher than conventional rates. Your credit score and down payment percentage will play a major role in determining your rate.

The difference in rates for a bank statement loan vs a conventional loan is due to lenders taking on additional risk with borrowers who cannot qualify using their tax returns. Rates for bank statement loans are not tied to what is happening in the market with conventional mortgage rates which is why you could see conventional rates falling while rates for bank statement loans could be rising.

Update August 2024 – Lenders who offer bank statement loans have increased their rates since the beginning of the year. The increases have followed the increases we have seen with both conventional and FHA rates. However, from a historical perspective, rates are still low and working with the right lender will help you to get the best rate possible.

One Month Bank Statement Loan Program

Very few lenders have a bank statement home loan program which only requires one bank statement. It is a no income documentation type of loan for self-employed borrowers. The income is stated on the loan application but not verified.

The deposits into the personal bank statements are not critical. What the lender will look at is the bank statement activity. For example, if the income stated on the bank statement loan application is $25,000 per month, but the activity or transactions on that statement looks like the borrower is living a very simple life, then the loan may not get approved.

Requirements for the One Month Bank Statement Loan Program

- The home must be owner occupied

- Borrower must have good credit

- The bank statement provided must be perfect with no negatives

- A large balance in the accounts is not required but will help

If a one month bank statement mortgage loan is something you may be interested in, then let us help you to find the right lender.

Bank Statement Loan Related Questions

Do I have to be self employed to get a bank statement loan?

At least one borrower on the loan must be self employed for a minimum of two years. There can be a second borrower that is a W2 wage earner.

How to bank statement lenders verify that you are self employed?

Bank statement lenders will ask for your business license if applicable, they will look for a business listing online, your website and also a written letter from your accountant verifying that you have been in business for a minimum of 2 years.

Does the home have to be my primary residence?

Bank statement lenders will finance your primary residence, a vacation home or an investment property too. Up to 4 unit properties and it can also be a condo. However, the down payment requirements may be different for investment properties.

Can I qualify for a bank statement loan without 24 month’s bank statements?

You may still be able to qualify using just 12 months or if you have other compensating factors in your favor. There are lenders who have a 12 month bank statement mortgage program.

Can I qualify for a bank statement loan with bad credit?

There are lenders who will still work with you even with low credit scores. Many individuals have been able to get a bank statement loan with credit scores as low as 500.

What is the maximum DTI ratio (Debt to Equity) requirement?

Some lenders will go up to a 50% DTI or more. So, fill out the form to have someone contact you to see whether you qualify.

Can I get a bank statement loan if I am retired? You may still qualify if you are receiving deposits. There are plenty of options for retired individuals.

Why do mortgage lenders need bank statements?

Lenders need to verify whether you have the assets needed to close the loan and reserves for the next few months’ payments. In the case of a bank statement loan, the lender wants to see that you have a steady flow of money coming in because they are going to use that flow to qualify you for the loan.

Do one month bank statement loans exist?

One month bank statement loans are available but the terms are not as favorable. You may see higher down payments, higher interest rates, less forgiving on your credit history and limited availability.

Are bank statement loans non QM loans? Bank statement loans are considered to be non QM or Non-Qualified because they do not meet the qualifications of a conventional mortgage.

Where can I find a bank statement loan? Bank statement loans are available in all 50 states. Not all lenders or banks offer them. That is where we can help you to get matched with the right lender.

Who are some of the lenders that offer bank statement loans? Some of the bank statement mortgage lenders include North Star Funding, Citadel Servicing, First National Bank of America, Mortgage Depot, Angel Oak Mortgage Solutions, Carrington, and others.

The list does vary and we are connected to the best bank statement lenders in the industry. As a consumer it is not easy to know which of these (or others) are best for you. Let us help you to find the lender that fits your scenario the best. That is what we do.

Still have questions? Contact us for a free consultation!

We are able to help you to find a bank statement loan with the best bank statement lenders in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.

Related Articles

How do Bank Statement Loans Work?

Bank Statement Loans for a Cash Out Refinance

Bank Statement Loan Mortgage Success Story