Florida Bank Statement Loans for 2024

Florida home buyers are now able to find bank statement loans. In the past, these loans were called stated income loans or even no documentation loans. Over time, the programs disappeared and then when they came back these loan programs developed into what we now call bank statement loans.

We will walk you through everything you need to know about Florida bank statement loans and then connect you with a Florida bank statement mortgage lender.

What is a Bank Statement Loan?

A bank statement loan is a program that will allow you to qualify using the average monthly deposits in your bank account without having to supply tax returns.

Florida Bank Statement Loan Programs

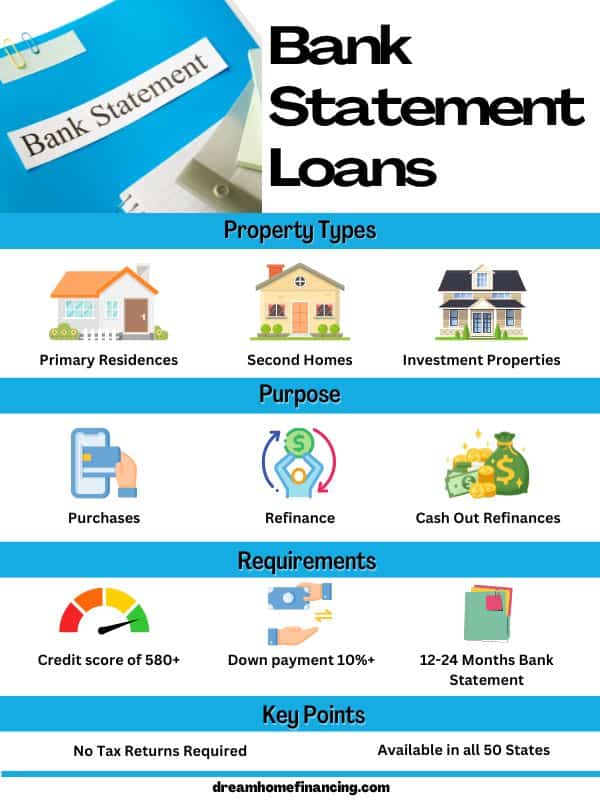

Borrowers will qualify based upon the 12-24 month bank deposits (both personal and/or business accounts). These bank statements are what the lenders will use to determine whether you have a steady flow of funds coming in to support your future mortgage payments.

Eric Jeanette – “Bank statement loans are a great solution for borrowers who cannot qualify using the income on their tax returns.”

How Do You Qualify for a Florida Bank Statement Mortgage?

These are just general guidelines and may vary slightly based upon your personal scenario. So, we encourage you to click to connect with a Florida bank statement lender to have a free no obligation discussion.

- You must be self employed

- Down Payment – 10%-25% down. Possibly more if you have a bankruptcy or bad credit.

- Credit Scores – Some lenders may allow scores as low as 580. We suggest speaking with one of our bank statement lenders to find out what your personal scenario is.

- Bank Statement Requirements – Most lenders require you to supply 12-24 months’ worth of bank statements. For business bank statements you may need 24 months.

- P&L Statements – It is possible that your lender may require you to provide a P&L statement.

- Assets – Your assets must be fully verified.

Bank Statement Loan Cash Out Refinance

Florida residents who are looking to cash out some equity from your home can apply for a bank statement loan cash out refinance. The difference between a purchase and a cash out refinance is your loan to value ratio will be capped at about 75-80%.

There are no restrictions when it comes to what you can spend the cashed out funds on. Hopefully it will be put to use in a way that will help build wealth or reduce debt, but ultimately it is your choice.

There are seasoning requirements which may vary by lender. This means you will need to wait a minimum of 6 months after your initial purchase before cashing out equity.

Bank Statement Loan for Florida Investments

If you are buying an investment property in Florida, you can use a bank statement loan to qualify without providing tax returns. For investments, bank statement loan guidelines may require larger down payments of at least 20%.

There are other options when purchasing an investment property. One of those is a DSCR loan where you qualify using the potential cash flow of the building.

Florida has been a place where many investors have chosen to focus on because the short term rental opportunity has been profitable.

Case Study

Joan was looking to purchase an investment property and selected Orlando has the market to focus on. Her idea was to purchase the home and then rent it out as a short term rental through Airbnb.

She decided to put 25% down on the home and at that time, her interest rate was 4.5%. The property was very close to Lake Buena Vista which means Joan was able to rent to vacationers who were visiting Disney, Universal, and Sea World. After expenses, she was making over $2,000 per month.

Self Employed Mortgage in Florida

Self employed home buyers in Florida have multiple options to finance a home which may or may not require income documentation depending upon which loan program you need.

The first program that we discussed earlier is the Bank Statement Loan where you are approved based upon the average monthly deposits into your bank account. Meanwhile, you may still have an opportunity to qualify for these other programs if the income documented on your tax returns is sufficient.

Conventional Loan for Self Employed

With a conventional loan, you will need to provide your income documentation for the past two years. These are the basic requirements:

- Self employed for at least two years

- Two years of tax returns with enough income to qualify

- Last two months bank statements

- Debt to income ratio of up to 43%

- Minimum credit scores of 620

- Down payment of at least 5%

FHA Loan for Self Employed

When applying for an FHA loan, self employed individuals will need to fully document their income just like they would with a conventional loan. These are the basic requirements.

- Self employed for at least two years

- Two years of tax returns with enough income to qualify

- Last two months bank statements

- Debt to income ratio of up to 56.9%

- Minimum credit scores of 500

- Down payment of at least 3.5%

USDA Loan for Self Employed

USDA loans are less popular than conventional and FHA, but many self employed home buyers consider applying for this loan when buying a home in a rural area. Here are the basic requirements:

- Self employed for at least two years

- Two years of tax returns with enough income to qualify

- Last two months bank statements

- Debt to income ratio of up to 43%

- Minimum credit scores not a program requirement

- No down payment requirement

- There are income limits which means you cannot apply if you earn too much

Frequently Asked Questions

Do I have to be self employed? Yes, at least one borrower on the loan must be self employed for a minimum of two years.

Can I finance an investment property? Yes, you can get a bank statement loan for an investment or even a second home.

Can I use my personal bank statements in addition to my business statements? Yes, most lenders will allow you to use both bank statement accounts.

If I have a low credit score, can I still qualify? Yes, some lenders will allow for scores as low as 580.

If I filed for bankruptcy, can I still qualify? Yes, some lenders will still help you with your loan but your down payment requirement may change.

If my business is losing money, can I qualify? You may still qualify based upon your bank deposits.

Who are some of the lenders that offer bank statement loans? Some of the bank statement mortgage lenders include North Star Funding, Citadel Servicing, First National Bank of America, Mortgage Depot, Angel Oak Mortgage Solutions, and others. However, we recommend that you click to follow this process to contact a lender and we will match you with the right one based upon your scenario.

Still have questions? Contact us!

We are able to help you to find a bank statement loan with the best bank statement lenders in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.