How to Get Closing Costs Waived

One of the major concerns that borrowers have is how much they will have to pay in closing costs regardless of whether they are purchasing a home or refinancing. This is why many borrowers are just as concerned about the closing costs as they are about the interest rate and often ask lenders to waive the closing costs.

Lenders cannot completely waive closing costs but can assist in finding ways to limit or even eliminate your out of pocket closing costs.

How Much are Closing Costs?

Closing costs for a mortgage will vary based upon the type of mortgage you are applying for, the loan amount, and also the lender you are dealing with. Many of the costs below will the same regardless of which lender you choose. You can expect your total closing costs to be anywhere from 2%-5% of the loan amount.

Lender Closing Costs

The lender closing costs are a part of their income on the loan and also how the lender offsets their own costs. These costs are typically the only ones that can potentially be negotiated. Some examples are as follows:

-

- Discount Points

- Origination Fees

- Application Fees

- Underwriting Fees

- Credit Report Fee

Third Party Closing Costs

Third party closing costs are not generated by the lender. They are costs that are likely the same regardless of which lender you select. Some of the third party closing costs are as follows:

-

- Title Fees and Insurance

- Appraisal

- Home Inspection

- Attorney Fee

- Flood Certification

Transactional Closing Costs

There are some transactional costs that are also part of your closing costs. Some of these will vary based upon the home you choose or even the day of the month that you close

-

- Prepaid Interest

- Tax and Insurance Escrows

- Recording Fees

We can provide you with a competitive quote with little to no closing costs. Just complete this form to begin.

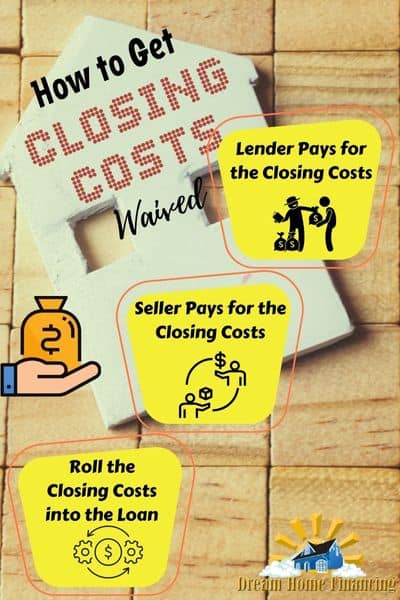

How to Get Closing Costs Waived

Closing costs cannot be waived by lenders because a portion of those costs are generated by third parties. However, lenders can assist in finding ways to limit or even completely eliminate your out of pocket closing costs.

These strategies are not eliminating the closing costs. They are simply ways to avoid having to bring the cash needed to cover these costs at the closing table.

1. Lender Pays for the Closing Costs

Lenders have real costs that need to he paid for. If they pay for your closing costs, it will come out of their pocket. One way to have the lender pay for your closing costs is if they can increase the interest rate offered on the loan. The higher the rate, the more income the lender can earn. They are able to use the additional income to offset and pay for your closing costs.

2. Seller Pays for the Closing Costs

Most loan programs allow for a seller contribution towards the closing costs. Depending upon how competitive the market is, it may be easier or more difficult to convince the seller to help with your closing costs. One way to do it is to offer a higher price for the home in exchange for a closing cost credit. This is something your lender and realtor can help you with.

3. Roll the Closing Costs into the Loan

In most refinance situations, you are able to roll the closing costs into the loan amount if you have enough equity in the home to cover it. This means you are essentially financing the closing costs. For purchases, there are instances where you are permitted to also finance some of the closing costs.

These strategies will help you to defer paying for closing costs at closing. In no situation are you able to truly get the closing costs completely waived

Can you Negotiate Who Pays Closing Costs?

You can negotiate who pays for closing costs and some of those strategies include the lender, the seller of the home, or even the realtor. Some lenders are able to use their ability to cover closing costs as a selling strategy by locking you in at a higher rate in exchange for covering your costs.

How to Negotiate Closing Costs with the Lender

You can absolutely negotiate closing costs with the lender but be strategic about your approach. Here are the steps on how to negotiate closing costs with the lender:

Step 1 – Before discussing closing costs, ask for a quote for the lowest rate and fees possible without points. Let the lender know you are comparing this against other lenders.

Step 2 – Look for fees that are lender generated. These include application fees, processing fees, underwriting fees, and more. Some of these can be negotiated.

Step 3 – If you want the lender to cover all of the remaining costs, negotiate what the rate premium will be in exchange for having them cover the costs. Keep in mind that in the long term, you will pay much more with the higher interest rate.

What If I Cannot Afford Closing Costs?

If you cannot afford closing costs, you have the option of having the seller pay for your closing costs. For FHA loans, the seller is allowed to contribute up to 6% of the purchase price towards the buyer’s closing costs.

The other two options that you have are to receive gift funds from a relative, or negotiate with your lender to cover your closing costs. This was outlined above.

Can You Get Ripped Off on Closing Costs?

You can get “ripped off” or pay too much for closing costs. One way to make sure that does not happen is to compare quotes from multiple lenders. Something to understand is that most of the closing costs are not generated by the lender. You should be looking at the lender fees if you are concerned whether you are paying too much. Other closing costs such as appraisals and escrows should be the same regardless of which lender you use.

Related Articles

How Much are FHA Closing Costs?

What Fees are on a Mortgage and Who Pays Them?

Discussion Topics