My Landlord Offered to Sell Me the House

There are many renters who find themselves in a situation where the landlord lets them know the home is going up for sale and they are offering a chance to purchase before it goes on the market.

If you received a call from your landlord offering to sell the house, you may have been surprised and unprepared to make the purchase. We will take you through your options and help provide you with some guidance and also get you pre-approved for a mortgage.

Click to Get Help Buying the Home From Your Landlord

How to Buy a Home From Your Landlord

You have a few options in how you approach the purchase of the home from your landlord. Regardless of which one of these options you go with, understanding the true value of the home without overpaying is critical.

Buying from your landlord without a real estate agent involved will provide you with some negotiation power and we will cover that below.

Rent to Own

You can enter into a rent to own contract with your landlord. This option can work great for you but may not work for your landlord because they are looking to sell the house now.

With a rent to own contract, you agree to a purchase price today, then a portion of your rent payments during the lease term is applied towards the down payment of the home. It is critical that you have a formal rent to own contract reviewed by an attorney.

The typical rent to own contract term is 1-3 years. You would have an opportunity to accumulate some of the down payment money through your rent payments.

You can see if this option will work for you, but we believe your landlord will be looking for the sale to happen sooner.

Seller Financing

If your landlord offered to sell you the house, you could buy the home with seller financing. In this situation, your landlord would be the bank providing you with the mortgage. The landlord will most likely want a down payment and the interest rate may be higher than what you can get with a conventional or FHA loan.

The benefit of using seller financing is the terms are negotiable and likely more flexible than what you will find with a lender. The down payment may be lower and you can negotiate the interest rate with fewer fees and closing costs.

The major benefit to you here is landlords typically do not have lending guidelines that you must meet. No credit score or income requirements. So, this is perfect when you cannot get approved for a traditional mortgage.

This option will work when your landlord does not need all of the proceeds from the sale of the home today.

Mortgage Options When the Landlord Offers to Sell the House

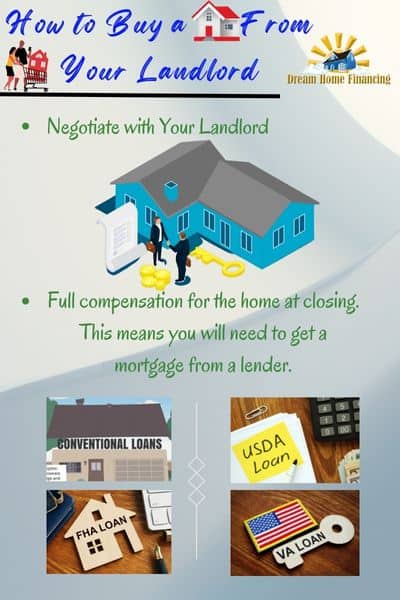

In most instances, when you purchase the home you are renting from your landlord, they are looking for full compensation for the home at closing. This means you will need to get a mortgage from a lender.

These are the most popular mortgage options when purchasing a home from your landlord:

Conventional Loan – With a a minimum credit score of 620, you can use a conventional loan to purchase the home with a down payment of at least 5%. With a down payment less than 20%, you will have PMI but that can be removed after your loan has been paid down to less than 80% of the value of the home. To get approved for an conventional loan, please complete this short form.

FHA Loan – This loan program helps when you have a small down payment, lower credit scores, or if you do not have enough income to qualify for a conventional loan. To get approved for an FHA loan, please complete this short form. You can also read more about the FHA guidelines on rent to own purchases.

USDA Loan – USDA loans are for the purchase of a primary residence that is located in a rural area. USDA loans do not have a down payment requirement but they do have income limits. Meaning, if you make too much then you may not qualify. Although there is no credit score requirement, most lenders are looking for at least a 600 credit score. To get approved for a USDA loan, please complete this short form. To get approved for a VA loan, please complete this short form.

VA Loan – VA loans are a zero down mortgage program for veterans, active military, or their surviving spouses. If you have VA loan eligibility, you may qualify for this great mortgage program. There is no credit score minimum which means even with bad credit, we can help you to get a VA loan.

Negotiate with Your Landlord When They Offer to Sell You the House

You should use this opportunity to ask for a seller closing costs credit since your landlord will likely save on realtor fees.

The first thing people would think to negotiate is the purchase price. However, you may want to keep that in your back pocket for now because you may need something else from your landlord.

If you do not have enough money to cover the down payment and closing costs, it may help to ask for a seller closing cost credit instead of a reduced purchase price. With an FHA loan, the seller is allowed to contribute up to 6% of the purchase price towards closing costs.

Ask for the entire 6% and apply as much as you can to the traditional closing costs, but also points to buy your rate down. If you can buy down the rate using the landlord’s seller credit, then your mortgage payment may be lower than if you negotiated a lower purchase price but at a higher rate. This can be a huge win for you.

You may also need to negotiate the timing of your closing. Maybe you are not ready to purchase the home right now due to the down payment, credit score, or employment situation. Therefore, offering to pay full price in exchange for waiting a few months to close may be what you need.

If you need to speak with someone to get pre-qualified or to ask some questions, then complete this short form.