Can You Get a Mortgage without Providing Tax Returns?

Most people have difficulty qualifying for a mortgage unless they provide the standard income documentation for the last two years. However, there are mortgage options for people who cannot provide tax returns or if your tax returns do not show enough income to qualify for a mortgage.

The lenders who offer mortgages without providing tax returns typically design these loan programs for self-employed home buyers. In most instances, they have a lot of business deductions lowering their net income to the point where the tax returns show very little income or even a loss.

Update 2/19/2024 – There are also options for W2 wage earners who also cannot provide tax returns.

Lenders who offer mortgages with no tax return requirement understand that the documented income on your tax returns is not as important as the amount of money that you are bringing in each month. As a result, they are instead asking to see 12-24 months bank statements. It is a great way to finance your dream home without having to provide tax returns.

Contact us to review your options or to get an idea what your rate would be. If you can just quickly complete the form below, to the right or at the bottom of your screen if you are reading this on a mobile device. A qualified loan officer will respond quickly.

Can you get a mortgage without providing tax returns?

There are lenders who have loan programs for individuals who cannot provide tax returns. They are designed for self employed borrowers who have not filed tax returns or show a very low net income.

Requirements for Mortgage Without Tax Returns

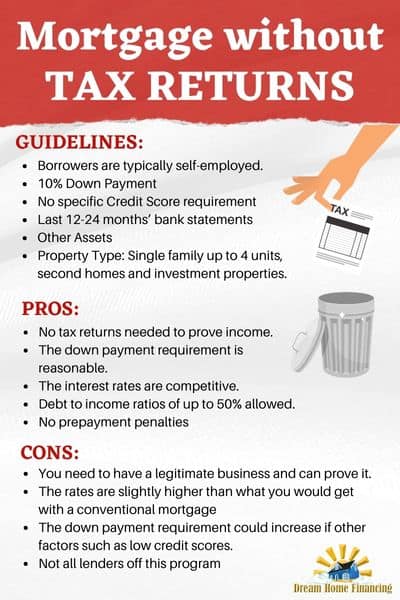

Borrowers are typically self-employed – The no tax return lender will need to verify this either with a business listing or a business license, a letter from your accountant, your website, etc. They may require one or more of these to prove that you are in business. 1099 borrowers may also qualify.

Down Payment – Some no tax return mortgage lenders may ask for a 10% down payment, but it all depends upon your unique scenario. In most instances, the down payment may be higher. Other factors will impact your down payment such as credit score, assets, and more.

Credit Scores – There are no specific credit score requirements, but your credit score will play a major role in what your down payment and interest rate will be. Let us help you to figure all of this out without having to run your credit.

No Tax Return Requirements – Most of our lenders will ask for your last 12-24 months’ bank statements. The bank statements will be used as income verification. They will use the average monthly deposits and will treat them as income. They typically use 100% of the deposits from your personal bank accounts and a portion of your business accounts.

Other Assets – It is important to list as many assets as possible to help with the approval of your mortgage application. Underwriters always look at compensating factors and assets is one of them.

Property Types – Single family up to 4 units, second homes and investment properties.

FHA Loans without Tax Returns

If you are a W2 wage earner, you may be able to qualify for an FHA loan without having to supply your tax returns. Your FHA lender will need for you to provide your W2’s for the past two years in addition to your recent pay stubs and bank statements.

The qualification process will be the same despite not having tax returns included in your loan application. Read [FHA Loans]

No-Tax Return Mortgage Rates

One of the first questions people ask when speaking to a lender is what are the rates. We just explained that not all lenders offer mortgage programs that do not require tax returns. There is risk involved for the lender when the borrower cannot provide all of the standard and customary documentation.

Due to increased risk, the rates for mortgages that do not require tax returns will be slightly higher than what you can expect from a conventional loan. Each lender will likely quote the rate differently but the two main factors will be your credit score and your down payment amount.

No-Tax Return Mortgage Pros and Cons

Pros

- No tax returns needed to prove income.

- The down payment requirement is reasonable.

- The interest rates are competitive.

- Debt to income ratios of up to 50% allowed.

- No prepayment penalties

Cons

- You need to have a legitimate business and can prove it.

- The rates are slightly higher than what you would get with a conventional mortgage

- The down payment requirement could increase if other factors such as low credit scores.

- Not all lenders off this program

Contact us by completing our form to the right or at the bottom and we will call to answer all of your questions.

No Tax Return Investor Loan

If you are looking to purchase an investment property, there are mortgage options which do not require tax returns. Today’s no tax return investor loan will simply verify there will be a positive cash flow on the property you plan to purchase. That combined with your credit scores will determine whether you are approved, what the down payment will be, and the rate.

No tax returns are required for this loan. Each property will be evaluated by the lender and your quote will likely be different for each. Read more about investment loan options.

No-Tax Return Mortgage Frequently Asked Questions – FAQ

Can I Get a Mortgage with Unfiled Taxes?

If you have unfiled taxes for the past year or two years, you can still get a mortgage. FHA loans for example do not require tax returns if you have W2s, good credit and a low DTI. If you are self employed, you can use just bank statements to qualify if you have not filed your taxes.

Can you qualify for a mortgage without providing tax returns?

There are programs available which do not require tax returns. We can help you to find the perfect lender for your scenario.

Do mortgage companies verify tax returns?

Most lenders for require you to provide tax returns for conventional loans. They will require you to provide all pages from the past two years plus IRS form 4506T which can be downloaded from the IRS website. However, there are a few of lenders who have programs where tax returns are not required.

How many years of tax returns are required to buy a house?

Usually lenders will require that you provide your last two years tax returns and also your W2’s. An exception can be made if you recently graduated college and only have 1 year of tax returns.

Which lenders offer mortgages with no tax returns required?

Your traditional lender that uses a Fannie Mae underwriting system will require that you provide 2 years of tax returns. However, portfolio lenders who underwrite the loans themselves or who use the Freddie Mac underwriting system will be able to yelp with your loan. A portfolio lender will keep your mortgage in their “portfolio” rather than sell the mortgages as investments to others. This allows them to be more flexible on the guidelines.

Do no tax return mortgage lenders require higher credit scores?

Although many lenders have minimum credit score requirements that may be higher than others, some of the lenders will allow for credit scores as low as 600 for self employed borrowers, and 500 for W2 wage earners.

Can I get a cash out refinance without providing tax returns?

There are loan programs available for a cash out refinance in addition to purchases and rate and term refinances. Some options vary depending upon whether you can qualify for an FHA loan today.

Do I need to provide tax returns for an FHA loan?

If you are trying to get an FHA loan then you will be asked to provide your last two years’ tax returns. The FHA guidelines do also allow you to qualify using only your W2s.

Is there a pre-payment penalty for a no tax return mortgage?

You should not see a pre-penalty with a mortgage without tax returns unless you are securing a mortgage to purchase an investment property. It is standard and customary for those loans to come with a 3 year pre-payment penalty.

Can I Buy a House Without Filing Taxes?

You can purchase a house without filing taxes if you have your W2s for the past two years, pay stubs for the past 30 days, and two months of bank statements.

What is a bank statement loan?

A bank statement loan is where you provide 12-24 months bank statements and the lender uses your average monthly deposits to qualify you for a mortgage.

We are able to help you to find a no tax return mortgage lender in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.