ITIN Home Loan Program Information

If you are an undocumented immigrant and do not have a social security number and need a mortgage to purchase a home, there is a program for you. The ITIN home loan is the program you are looking for and it does not require a social security number. All you need is your ITIN Card (Individual Tax Identification Number) and you are on your way to home ownership. This ITIN loan program is available in all 50 states.

We have helped many immigrants with an ITIN number find a mortgage to purchase their dream home in the United States through this simple program that is easy to qualify for.

If you are already familiar with the ITIN loan program and want to get started, then complete this form. Please feel comfortable knowing that our conversation with you is confidential and we can help you in all 50 states and there are Spanish speaking loan officers available.

We also work with realtors to help their clients get pre-approved so they can begin shopping for a home.

What is an ITIN Number?

An Individual Taxpayer Identification Number (ITIN) is a unique identification number which is issued by the Internal Revenue Service (IRS). They are granted to individuals who are not eligible for a Social Security Number (SSN).

Importance of ITINs for Non-U.S. Residents

ITINs can help non-U.S. residents as it allows them to comply with U.S. tax laws and fulfill their tax obligations. Many financial institutions, including lenders, require individuals to have an ITIN when applying for certain financial products such as mortgages.

What is an ITIN Loan?

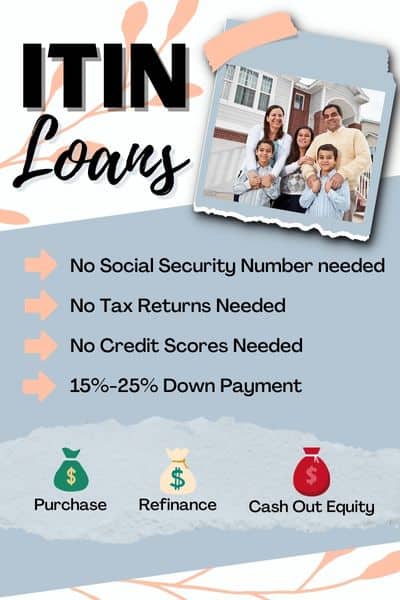

ITIN loans are designed for borrowers who do not have a social security number, but can provide an ITIN number as an alternative form of identification. These are non qualified mortgages that do not meet FHA or conventional mortgage guidelines. You can expect a down payment of 15-25% and will need a 2 year work history.

ITIN Loan Pros and Cons

Pros of an ITIN loan

- No social security card is required

- Traditional credit may not be required

- No legal documents needed to prove US residency

- The rates are better than hard money loans

- It enables you to own a home in this country without documentation

- Gift funds may be allowed to help with your down payment

Cons of an ITIN loan

- The ITIN down payment requirements are higher

- The ITIN rates are typically slightly than conventional mortgages

- Some lenders do not allow ITIN loans for investment properties

- Fixed rate mortgages are offered with various repayment terms.

ITIN Loan Requirements and Eligibility

To qualify for a mortgage with an ITIN number, several factors must be considered. Lenders have specific requirements regarding credit, income verification, and down payment. Understanding these qualifications can help you navigate the process successfully.

These are the basic requirements needed to qualify for an ITIN loan

- You must have at least 15% down payment depending upon your credit score. Gift funds may be accepted

- You need a minimum of a two year work history (wither W2 or self employed) and one year proof of income.

- Provide pay stubs for the past 30 days for W2 employees

- Self employed can qualify using bank statements instead of tax returns. This is called a bank statement loan.

- Some lenders will allow your debt to income ratio to be as high as 55%

- Minimum credit score of 600. You can still qualify without a credit score.

*Spanish speaking loan officers are available.

After an initial discussion, a loan officer can provide you with what you need to make your decision. If you decide to move forward, a closing is possible within 30 days.

Credit Requirements for ITIN Mortgage Loans

Your credit history will be carefully evaluated when applying for an ITIN mortgage loan. Lenders typically look for a minimum credit score, which varies among lenders.

Although credit requirements may be more lenient than traditional mortgages, having a good credit score increases your chances of approval and may provide better terms.

Today, most lenders are looking for credit scores of at least 600 from individuals who are applying for an ITIN loan.

Income Verification for ITIN Mortgage Loans

Income verification is the primary evaluation factor of the mortgage qualification process. As an ITIN mortgage applicant, you must provide documentation demonstrating a stable and sufficient income to make mortgage payments. This may include pay stubs, tax returns, bank statements, or other supporting documents. Lenders will assess your income to make sure you can afford the mortgage payments.

Self employed borrowers may qualify using a different method which will be discussed below.

What types of properties qualify for an ITIN loan?

Typically the following property types are accepted as long as you occupy them as your primary residence.

- Single family homes

- Condos

- Townhomes

- 2-4 unit residential buildings

- Mobile Homes

If you are buying a second home or a rental property, we likely will have a lender who can help finance those properties as well.

Speak to Us Now About Your ITIN Home Loan

Differences between Traditional Mortgage and ITIN Mortgage

While traditional mortgages are primarily available to U.S. citizens or permanent residents with a Social Security Number (SSN), ITIN mortgages cater to non-U.S. residents with an Individual Taxpayer Identification Number (ITIN).

The primary difference is the type of identification number used to qualify for the loan. ITIN mortgage loans are designed for individuals without an SSN but have an ITIN issued by the Internal Revenue Service (IRS).

Furthermore, the application process for ITIN mortgage loans may have slightly different requirements and documentation than traditional mortgages.

ITIN Loans for Self Employed

If you are self employed, you can get an ITIN loan. You will need to have been self employed for at least two years. You may also be an independent contractor who receives a 1099 form.

Tax returns will not be required but will need to provide 12 months bank statements to show deposits into your accounts. These deposits (or a portion of them) will be used as income on your loan application.

Other Factors that Can Help Qualify For Your ITIN Loan

In the lending business, things are not always perfect. At the same time, the lenders do allow for some compensating factors which can help you to qualify if you are not able to meet one of the requirements outlined above. They take other things into consideration which can help you. Therefore, we recommend that you look into these additional activities below.

- Credit Cards – Many immigrants have not established credit in the United States and/or may not have a credit score. One of the things you should do is apply for one or two credit cards. Make a few purchases per month and then pay off the balance in full. This will help establish some type of credit record that lenders can review. It will make lenders feel comfortable about your ability and willingness to repay your debts.

- Bank Accounts – Lenders like to see that you have some money saved. You will need a down payment for your ITIN Loan and you cannot come to the closing table with a shoe box full of money. So, get at least 1-2 bank accounts started. Try to keep your down payment money in that account and it should be there for at least 2-3 months BEFORE you apply for your ITIN Loan.

- Employment – They will look at your employment history. Make sure that you keep a steady job at all times. No gaps in your employment and staying in the same type of work for a long time does help.

- Alternative Credit Sources – Another thing you can do is provide statements from your utility company, phone company, insurance company, etc showing that you are making payments on time. You could even ask them to provide you with a letter or a statement showing all of your on time payments.

ITIN Loan Down Payment Requirement

The minimum down payment requirement for an ITIN loan is 15% with excellent credit. Your credit score and the loan amount are the most important things that lenders consider when determining your down payment. The higher your credit score and the larger the loan amount, the greater the chances to reduce your down payment.

You may use a gift from a relative to help with the down payment. For example, if you need down payment of $20,000, a relative can provide you with half of that ($10,000) to help purchase the home. Let us help you to determine what your down payment will be based upon your loan scenario.

ITIN Loan Interest Rates

The interest rates for ITIN loans are competitive but they are not as low as Conventional or FHA loans. ITIN interest rates are still low but like any other mortgage program, the rate the lender will quote is closely tied to your credit score and down payment amount. The higher you score and the more you put down, the lower your rate will be.

If you are purchasing a home during a time when rates are higher, you are able to refinance when the rates come down without a prepayment penalty.

ITIN Mortgage Lenders

Home buyers with an ITIN number have difficulty finding a lender because conventional Fannie Mae Guidelines do not permit applicants with an ITIN number.

The ITIN mortgage lenders are accepting borrowers with ITIN numbers and they are holding the loan in their own portfolio. Therefore, they create their own requirements for ITIN loans. The requirements usually involve higher down payments and the ability to qualify using bank statements.

There are many changes in the ITIN loan guidelines from the few lenders who offer the program. Depending upon your scenario, there may be a specific lender who can help you. Contact us here and we will help determine who the best ITIN lender is for you. Then, a bilingual loan officer will call you to help with your pre-approval.

ITIN Loans in California

ITIN loans are available in California where there are many ITIN card holders who wish to purchase a home. The down payment requirements in California for an ITIN loan are slightly different. The smallest down payment possible is 20%. We have multiple options to help you if you plan to purchase or refinance.

ITIN Loans in Texas

Texas is another state where ITIN loans are very common. If you are an ITIN card holder and need help in Texas, then please complete this form so we can help you to get started or to simply get an ITIN rate quote.

In Texas, the minimum down payment today is 15%. The lending requirements are constantly changing so it will be helpful to check with us on what today’s requirements are.

How to Get a Loan with an ITIN Number

If you have an ITIN number, you can get a loan by providing your ITIN identification, tax returns, pay stubs and two months of bank statements. If you are self employed, then you can get an ITIN loan using bank statements instead of tax returns.

Your first step is to contact us by completing this short form.

Can I Buy a House with an ITIN Number?

You can buy a house with an ITIN number by providing W2s from your job, or bank statements if you are self employed.

Importance of ITINs for Non-U.S. Residents

ITINs can help non-U.S. residents as it allows them to comply with U.S. tax laws and fulfill their tax obligations. Many financial institutions, including lenders, require individuals to have an ITIN when applying for certain financial products such as mortgages.

Obtaining an ITIN Number

To obtain an ITIN, individuals must submit an application to the IRS along with the required documentation, such as a completed Form W-7. Acceptable documentation includes a valid federal income tax return, supporting identification documents, and a nonresident alien individual’s passport. The IRS carefully reviews the application and documentation before assigning an ITIN.

Summary

If you have an ITIN number, a 2 year work history, a down payment, and a minimum credit score of 600, then you can buy a home. If you do not have an ITIN number yet but need one, then you can complete this ITIN application at the IRS website.

ITIN Home Loans – Frequently Asked Questions

Q: Should I be concerned about being deported if I apply for an ITIN loan?

A: ITIN lenders only want to help with your mortgage and they do not communicate with the government about your residency status. Therefore, you should not be concerned about deportation.

Q: How much do I need for a down payment for an ITIN loan?

A: Usually a minimum of 15% down payment is required for an ITIN loan and that will depend upon the lender, your location and your credit scores.

Q: What kind of interest rates can I expect with an ITIN loan?

A: The interest rates for ITIN loans are slightly higher than if you were to apply with a social security number.

Q: Do I need to provide tax returns when applying for an ITIN loan?

A: You will need to provide tax returns for the past two years if you are a W2 wage earner. If you are self employed, no tax returns are needed.

Q: If I apply for an ITIN loan, will my information be reported to the US Immigration Services Dept?

A: The US Immigration Services Department will never see your loan application and they will not know you are buying a home.

Q: If you are not a citizen but pay taxes, can you get an ITIN mortgage?

A: If you are not a US citizen but you can document your income and meet the lender’s guidelines, then you can absolutely get an ITIN loan.

Q: Are ITIN loans only available for home purchases?

A: You can use an ITIN loan to purchase, refinance or cash out equity from your home.

Q: How long does it take to get approved for an ITIN loan?

A: You can get approved for an ITIN loan in 24 hours. However, it can take 3-4 weeks to close your loan.

Q: Can I use a cosigner to help qualify for an ITIN loan?

A: You can use a cosigner to help qualify for an ITIN loan if you do not have enough income to get approved for the loan amount that you need.

Q: Is there down payment assistance available for ITIN loans?

A: It may be possible to find down payment assistance to help qualify for an ITIN mortgage.

Click for an ITIN Mortgage Rate Quote

Related Articles

Foreign National Mortgages – If you are a foreign national, there are mortgage options for you as well. This article will guide you through the process.

What Do I Need to Get Pre-Approved For a Mortgage? – This article will detail all of the documents that will be needed in addition to your ITIN number.

How to Budget When Buying a Home – This article will help you to understand the budget needed to buy a home. This is in addition to the down payment requirements that were outlined above.

We are able to help you to find an ITIN loan with the best ITIN lenders in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.