Mortgage After Bankruptcy in 2024

If you have filed for chapter 7 or chapter 13 bankruptcy, then you can still qualify for a mortgage just one day out of bankruptcy. Today, there are thousands of people who are trying to find a mortgage after filing for bankruptcy. In the past, finding a mortgage after a bankruptcy was not the easiest thing to do. The good news is that today you can get a mortgage just one day out of bankruptcy.

Understanding Bankruptcy and its Impact on Obtaining a Mortgage Approval

When applying for a mortgage with a recent bankruptcy, you will likely have difficulty securing a mortgage approval from a traditional bank. There are standard waiting periods after a bankruptcy discharge before you can apply for a mortgage.

We will review the bankruptcy waiting periods below, but it if you are thinking about filing for bankruptcy and also would like to apply for a mortgage, then speak with us before making any final decisions. The timing of your bankruptcy process and also the type of bankruptcy will determine if or when you can get approved for a mortgage.

When applying for a mortgage before the bankruptcy waiting period has elapsed, the lender will pay close attention to your employment stability and ability for repayment of the loan. Your approval will also be based upon whether you have had any recent late payments on other mortgages. You can expect the down payment and mortgage rate to be a bit higher.

If you need to apply for a mortgage before the standard waiting period has concluded, there are still non qualified mortgage options available.

How Long after a Bankruptcy Can I Qualify for a Mortgage?

There are bankruptcy lenders who can help with your mortgage application even just one day out of chapter 7 or chapter 13 bankruptcy. You will likely need a larger down payment and show that you are taking financial steps to improve your credit.

Below, we will take you through some mortgage after bankruptcy options and then connect you with some of the best bankruptcy lenders. We understand that you area dealing with a lot and having a bankruptcy is not easy. Let us help guide you through this process.

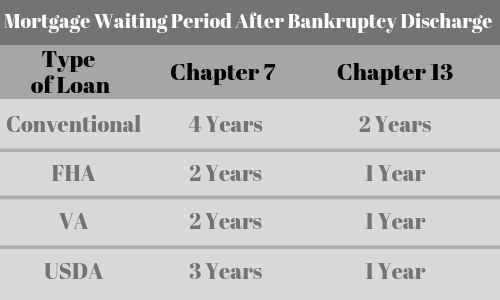

| Type of Loan | Chapter 7 | Chapter 13 |

| Conventional | 4 years | 2 years |

| FHA | 2 years | 1 year |

| VA | 2 years | 1 year |

| USDA | 3 years | 1 year |

| Subprime | 1 day | 1 day |

* Mortgage after bankruptcy waiting period chart

Mortgage after Bankruptcy Waiting Period

Every type of loan has different waiting period requirements. Here are some of the basics:

- VA Loans after bankruptcy– 2 year waiting period

- FHA Loans after bankruptcy – 2 year waiting period

- USDA Loans after bankruptcy – 3 year waiting period

- Conventional mortgages after bankruptcy – 4 year waiting period after chapter 7 and 2 years after chapter 13

- Non-QM Subprime Mortgages – Available just one day out of bankruptcy.

Depending upon your scenario, we can find a mortgage for you just ONE DAY after your bankruptcy has been discharged. The rules for applying for a mortgage is the same regardless as to whether you filed a chapter 7 bankruptcy or chapter 13 bankruptcy.

Click To Speak With A Loan Professional Who Can Help

FHA Loan Requirements After a Bankruptcy

For an FHA loan, the waiting period will differ for a Chapter 7 versus a Chapter 13 bankruptcy.

- You will have a two year waiting period first after filing for Ch 7 bankruptcy.

- If you had a chapter 13 bankruptcy, you can apply for an FHA loan after you have made just 12 on time bankruptcy payments.

- FHA mortgage loans require both taxes and insurance to be escrowed.

- They require you to have a mortgage insurance premium (MIP)

- You must have a sustained history of employment (typically at least two years)

- The home must be your primary residence.

- You must occupy the home within 60 days of closing and live in the home for the first 12 months.

VA Loan Requirements After a Bankruptcy

You can get a VA loan after a bankruptcy if you are able to wait two years from your bankruptcy filing date. You will also need to show that you have your credit back in good standing with on time payments.

- You will have a two year waiting period first after filing for bankruptcy

- You will need to meet the eligibility criteria as a veteran

- Zero down payment

- No PMI required for a VA loan

- You must meet the minimum income requirements

- You will have to pay the VA funding fee which can also be borrowed.

USDA Loan Requirements After a Bankruptcy

USDA loans are a zero down payment program for homes in a rural area. Here are the basic requirements to qualify:

- You will have to wait three years after filing for bankruptcy

- Must be a citizen of the US or be an eligible non-citizen

- Must be legally able to borrow (ie, must meet the age limits)

- Must occupy the home as your primary residence

- Must currently be without safe and sanitary housing now

- Must not have the current ability to obtain a conventional loan from other sources and lenders

- May not be barred from participating in any federal loan programs.

- Must meet the income limits set by the program

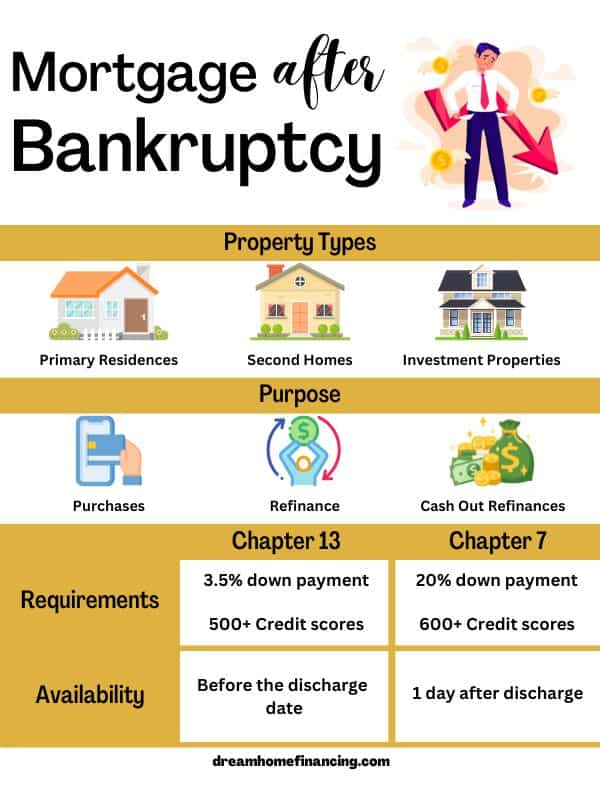

Getting a Mortgage With a Recent Bankruptcy – Less than 2 years

- You will need to have up to 20% down payment if your bankruptcy was less than 2 years ago

- Your credit score can be less than 600 and as low as 500

- Self employed borrowers can qualify for this loan

- Interest rates will be slightly higher than a conventional loan

- Very few lenders have this program. Let us help you

Mortgage After Chapter 7 Discharge

Fannie Mae guidelines will require you to wait two years from the discharge date before you can qualify for a mortgage with a chapter 7 bankruptcy. However, there are subprime lenders who can help with a mortgage after chapter 7 discharge even if that discharge was as recent as yesterday.

If you plan to apply for a mortgage after a chapter 7 discharge, you should focus on establishing a new positive credit trend by making on time payments and beginning to prove that you are credit worthy.

Although you will be able to get a mortgage after a chapter 7 discharge with a credit score as low as 500, the higher the score, the lower your down payment will be. Your credit score will also play a major role in what the interest rate will be.

Mortgage After Chapter 13 Discharge

Getting a mortgage after a chapter 13 discharge is a bit different in that you may be able to get approved with less than a 2 year waiting period. With a chapter 13 bankruptcy, you are committing to paying back your debt and will likely be on a payment plan. It is important that you stick to the plan and make your payments on time.

We have a handful of FHA lenders in our network who will finance your home with an FHA loan after you have made at least 12 on time Chapter 13 bankruptcy payments. This can be done well before the loan has been discharged. If you would like to get approved for an FHA loan without waiting until 1 year after your discharge, then we can help.

There are also nonprime lenders who are willing to finance your home immediately after a chapter 13 bankruptcy discharge. They will look at your credit scores to determine what the down payment and interest rate will be.

You may also have the ability to get an FHA loan with a chapter 13 bankruptcy without waiting the full two years.

How to Get Approved For a Mortgage After Bankruptcy

Bankruptcy friendly mortgage lenders are going to look at your entire situation to evaluate whether they feel comfortable moving forward with your mortgage. Extenuating circumstances will play a part. They will want to know why you filed for bankruptcy and also what you have been doing since then. Here are some of the things you can do to improve your chances.

Improve Your Credit Score – Immediately after filing for bankruptcy, your credit score will drop a minimum of 100 points. Now, you need to begin building it back up. The better your credit score, the more likely you will be able to get a loan. Read about how to improve your credit score.

Down Payment Amount – When you are ready to apply for a mortgage after your bankruptcy, one of the key factors will be how much you can put down for a purchase or how much equity you have in the home for a refinance. The more money you put down, the easier it will be to get a loan. The down payment amount may also impact your interest rate too. Depending upon how recent your bankruptcy occurred, you may have to put more down than if your bankruptcy happened over two years ago.

Make On Time Mortgage Payments – If you have a mortgage when you file for bankruptcy, it is extremely important that you do not miss, or are not late on any mortgage payments. In fact, this may be a deal breaker. Do everything you can during this difficult time to make on time mortgage payments.

Which Are The Best Lenders For a Mortgage After a Bankruptcy?

There are only a handful of lenders who offer the program and their guidelines are constantly changing. First, your personal situation and scenario will determining which bankruptcy lender is the best for you. Where the home is located will also matter because not all bankruptcy lenders are licensed in every state.

Below we will give you a few examples of some lenders who may be able to finance your loan. The good news is that we are keeping up with all of this throughout our extensive lender network. All you need to do is click to connect with a bankruptcy lender, answer a few simple questions and we will connect you with what we think will be the best fit.

- Carrington Mortgage – Carrington has quite a bit of flexibility when it comes to length of time since your recent bankruptcy and also your credit score. You can expect to need 20% down if your bankruptcy is less than two years old. Contact

- First National Bank of America (FNBA) – FNBA also has no waiting period to get a mortgage after a bankruptcy. They require a minimum of a 20% down payment but are very flexible when it comes to your credit scores. Their income or debt to income requirements are also extremely lenient. Contact

- Citadel Servicing – Citadel will finance your loan just one day after a bankruptcy. Their credit score minimums are in the low 500’s and you can get a mortgage with as little as 10% down depending upon your credit score. Contact

- Angel Oak Mortgage Solutions – Angel Oak will finance your loan just one day after a bankruptcy. Their credit score minimums are in the low 500’s and you can get a mortgage with as little as 15% down depending upon your credit score. Contact

- Peoples Bank – Peoples Bank has a variety of loan options not only in the programs (FHA, VA and USDA) but also different options based upon whether your bankruptcy is a chapter 7 or chapter 13. Their credit score requirements may be a bit higher. Contact

- ACC Mortgage – ACC Mortgage allows borrowers to get a mortgage just one day after bankruptcy with their “Second Chance Purchase Program”. Their down payment requirements vary and they are extremely flexible when it comes to your credit scores. Contact

We are fully aware of the various lender guidelines and can help to determine which is the best option for you. Click to discuss your bankruptcy mortgage options with us.

Refinancing After a Bankruptcy

Your ability to refinance after a bankruptcy will obviously be determined by the following factors:

- The proposed loan amount versus the value of your home (loan to value ratio)

- Your credit scores – immediately after your bankruptcy, begin repairing your credit

- Other compensating factors such as your income and employment history

- Whether you had recent late mortgage payments.

Refinancing is definitely possible after a recent bankruptcy. Your options will vary based upon how long ago your bankruptcy was discharged, and whether your bankruptcy was a Chapter 7 or a Chapter 13.

We can help even just one day after your bankruptcy has been discharged. If you are looking to cash out equity, you may be limited on the total loan amount based upon the appraised value of your home.

Can I Refinance My Mortgage After Chapter 7 Bankruptcy?

You are able to refinance your mortgage after a chapter 7 bankruptcy if you are less than two years from the discharge date. If you are beyond the two year mark, then you can refinance using an FHA loan.

Frequently Asked Questions – Finding a Mortgage After Bankruptcy

Will I be able to buy a home after a bankruptcy?

You can buy a home after bankruptcy. Much will depend upon your personal scenario and some of the details outlined above.

What credit score is required after a bankruptcy?

The credit score needed for a mortgage after a bankruptcy will vary by lender. The higher your score, the better your chances will be to qualify, but you should target a minimum of a 620 FICO score. However, some of our subprime lenders can get it done with lower scores. For FHA loans, the minimum credit score required is 500.

How much of a down payment will I need after a bankruptcy?

The down payment requirement after a bankruptcy is most likely a minimum of 10-25% depending upon your scenario. Each lender has different requirements so it is best to let us help to figure out which lender will work for you.

Which lenders will give me a loan with a bankruptcy?

Not all lenders will have mortgage solutions for you with a recent bankruptcy. The traditional large banks in your neighborhood likely cannot help. We are connected to the lenders who have these programs.

Can I refinance my home after a bankruptcy?

You can refinance after a bankruptcy and the guidelines are the same regardless as to whether it is a purchase or a refinance. You also may be able to get a cash out refinance after a bankruptcy.

Do I need a job to get a mortgage after a bankruptcy?

You must have a source of income regardless as to whether you had a recent bankruptcy. Lenders want to be sure that you have the ability to repay the loan.

How long do I have to wait to get a mortgage after a chapter 13 bankruptcy?

For chapter 13 you will most likely have to wait 2-4 years if you want a conventional or government loan. You will have no wait at all of you get a subprime loan.

How long do I have to wait to get a mortgage after a chapter 7 bankruptcy?

For chapter 13 you will may be able to cut your wait to just 1 year if you want a conventional or government loan. You will have no wait at all of you get a subprime loan.

Do I have to wait a few years when buying a house after a bankruptcy?

You do not have to wait a few years to buy a house after a bankruptcy because we work with lenders who will finance your loan just one day out of bankruptcy. For a conventional loan, you will need to wait at least 4 years.

How can I improve my chances of being approved for a mortgage after bankruptcy?

The best way to improve your chances of being approved for a mortgage after a bankruptcy is to improve your credit scores, make on time payments on all credit accounts, and have a larger down payment.

Does the property have to be my primary residence when applying with a recent bankruptcy?

The property that you plan to finance after a bankruptcy does not have to be your primary residence. It can be a second home or even an investment property.

Can I get a mortgage after a recent foreclosure?

You can get a mortgage after a recent foreclosure, but the waiting period for all types of traditional mortgages will be longer. We have subprime lenders who can help just one day after your foreclosure. However, because you likely missed many mortgage payments, lenders will be much more careful before issuing an approval.

Mortgage After Bankruptcy Facts

Mortgage After a Recent Bankruptcy Statistics

We are able to help you to find you a mortgage after a bankruptcy in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.