Stated Income Loans – Stated Income Lenders

Do stated income loans exist in 2024?

Stated income loans exist today but they are different now than what was offered prior to the housing market crash. We will take you through your stated income loan options that are available today, what you need to qualify, and how you can apply for and secure an approval for a a purchase or refinance.

Click to Connect With a Stated Income Lender

What Stated Mortgage Programs Are Available Now?

In 2024, self-employed borrowers, freelancers, 1099 workers and W2 wage earners are able to get stated income loans with a larger down payment and at least average credit scores. This program will not look closely at your job or business and will not use any income documentation as a qualification basis to approve your loan.

There is also another program that requires applicants to use their bank statements as proof of income instead of supplying tax returns. You will provide your business bank statements and personal bank statements. This type of mortgage is called a bank statement loan or alternative documentation loan.

Self employed individuals have a problem in that they take all of the legal tax deductions, but then when it comes to applying for a mortgage they are showing a much lower net income. The net income after expenses is what makes it very difficult to qualify for a conventional mortgage.

The basic elements of today’s stated income loan program is for the lender to see a larger down payment or a steady flow of money coming into your bank accounts. They will typically use the last 12-24 months bank statements to get an average monthly flow. A percentage of the average deposits are used and will be considered to be “income”.

If you cannot supply personal bank statements or business bank statements with steady deposits, we still have an option for you to simply state your income.

We have helped borrowers with this mortgage program and are viewed as the leader in the industry since 2002. It is best to speak with us to get the specifics on the program and guidelines in your state and what can be done for you. We are helping people to get these loans every day. Click for a free consultation.

Read our article about bank statement loans. They are today’s better alternative if you are self employed.

Stated Income Loan Benefits

- Helps individuals who cannot fully document their income to qualify

- Does not require you to provide your tax returns

- Low down payment options available

- Stated income mortgage rates only slightly higher than conventional rates

- You can refinance in the future when your income documentation status changes without a prepayment penalty

What Others Are Saying About Stated Loan Programs

Refiguide.org – “2024 is a great year for no income verification loans“. They also said “stated income loans are making a come back and there are more programs today for borrowers than in prior years.”

My Mortgage Insider – “stated income loans are great for borrowers who have stacks of tax returns.“

The Mortgage Reports – says in summary that there are millions of self employed borrowers out there and this is a good time for them to qualify for a mortgage.

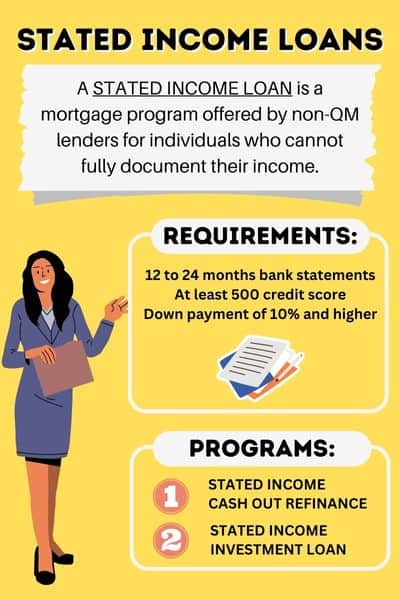

Stated-Income Loan Requirements

The stated income loan qualification requirements will change as the lending environment and availability to fund the loans also change. This is much different than conventional and government loans which remain stable and unchanged for many years.

These are the stated income loan eligibility requirements that exist today for those who wish to apply and qualify without fully documenting their income.

- There will be a minimum of a 10-25% down payment needed for a purchase.

- Refinances will allow up to 80% loan to value and possibly less for a cash out refinance.

- You may be asked to provide bank statements showing the funds needed to close (down payment, closing costs, and reserves).

- You will need credit scores over 580 today.

- Stated income credit score requirements vary by lender but the higher your credit score, the lower the down payment requirement will be from our stated income lenders.

- If you have a foreclosure or bankruptcy, then certain lenders may require a higher down payment.

- No recent late mortgage payments on an existing or recently closed mortgage.

- No income verification via tax returns

*These requirements are subject to change.

If you are ready to speak with a stated income lender, we recommend you click for a free consultation now or view a list of the recommended stated income lenders.

Property Requirements

Lenders who offer stated income loans are able to help finance the following property types:

- Single family

- Duplex

- 3 Unit

- 4 Unit

- Mobile home

The property that you purchase or refinance can be either a primary residence, second home or an investment property. The down payment may vary based upon the number of units and also whether you plan to occupy the home as your primary residence.

Pros and Cons of Stated-Income Loans

- Stated income loans allow borrowers to qualify when conventional loans will not work

- No need to provide tax returns for qualification purposes

- Rates are still competitive for loans with reduced documentation

- Stated income lenders may require as little as 10% down.

- There is no PMI

- You may still need to provide bank statements

- None of the government programs such as FHA apply. There is no such thing as a stated income FHA loan.

- The rates can be higher especially with lower credit scores

- Most traditional lenders and banks do not offer the program.

If you cannot fully document your income then this is the loan program that you likely need. You can always refinance in the future without a prepayment penalty.

**See our stated income loan frequently asked question section below

Stated Jumbo Loans

If you are looking for a jumbo stated income loan, then we can help you. Depending upon your credit, our jumbo stated income lenders determine what your minimum down payment will be. Jumbo stated income loans start can go up into the millions depending upon the stated income lender.

The down payment for the jumbo stated income loan will likely be higher. This is due to the added risk on the lender’s part when providing financing without asking for proof of income.

Stated Loans for 1099 Contractors

If you are a 1099 contractor and cannot qualify for a mortgage using your tax returns, then a stated income loan may work for you. The lender will use income that makes sense for your occupation without having to document that income. You can expect the down payment requirements to be a bit higher.

The lender will be looking for liquid assets, but also stability as a 1099 contractor showing that you have been doing this kind of work for at least two years. Showing significant assets, will help during the underwriting process to secure a mortgage approval.

This program is going to also help people who were W2 wage earners and recently transitioned to a 1099 income based job less than two years ago. Without 2 years as a 1099 contractor, you cannot qualify for the traditional mortgage programs such as conventional or FHA. This makes a stated income loan a great option for now.

Stated Income Requirements for Investment Properties

You may also be able to find Stated Income Investor Loans for Investment Properties. For an investment property, this can be done with 20% down depending upon the property type and loan amount. You can also expect the interest rate to be higher when you are looking for a stated income loan for an investment property.

In these instances, the lenders will look at the cash flow or anticipated income of the building or property when determining whether to proceed with a loan approval. There is no job needed for when you are purchasing or refinancing an investment property.

Borrowers who have experience in owning investment properties may be offered better terms. This means a lower down payment and potentially a slightly lower interest rate.

In addition to a stated loan, you can find another type of Non-QM loan called a DSCR loan. DSCR means “debt service coverage ratio” and it simply requires the potential rent from the investment property should cover the debt service. It is the program that many real estate investors prefer.

Do you need a special mortgage for an investment property? Simply contact us and we can help.

Stated Income Home Loan Rates

The interest rates for stated income loans are going to be a few percentage points higher than a conventional loan. For example, if conventional rates are at 6%, then your stated income rate may be 7% or more.

The rate you are offered is going to be directly tied to the following factors:

- Type of property

- Whether you plan to occupy the property as your primary residence, second home, or investment.

- Your credit score

- Your down payment

These factors play a role when establishing interest rates for all types of mortgages and not just stated income loans. The only way to truly know what your rate can be is to get a quote. Complete this short form for a free rate quote without pulling your credit.

Stated Cash Out Refinance or HELOC

When interest rates are high, homeowners and investors may still want to access the equity in their homes or investments. However, if the interest rate on the first mortgage is low, then a refinance may not be an attractive option.

There are limited options available for a second mortgage or a HELOC to cash out the equity in the property. Expect the loan to value ratio to be capped at 70%-75% LTV.

If your first mortgage balance is low, then you should consider a simple cash out refinance of that first mortgage because your blended payment may be the same.

When cashing out, lenders are also looking for at least 12 months of seasoning from your purchase date of the property.

Stated Programs with a Recent Bankruptcy

If you have been through a recent chapter 7 or chapter 13 bankruptcy, then a stated-income loan may still be an option for you. Be prepared to put at least 20%-30% down depending upon your credit scores.

The interest rate for the program will also be higher, but once you are beyond the traditional waiting period for a bankruptcy, then you can refinance into an FHA loan with a much lower interest rate.

Application Process

When applying for the loan, the process will be as follows:

- You will need to complete a full application but without providing your income documentation.

- The income you referenced will be “stated” since this is a stated loan. The underwriter will make sure the income that you state will make sense for your line of business. This also means no pay stubs will be collected.

- You will need to fully document your assets. This will help the underwriting department to verify that you have financial stability.

- The lender will pull your credit to verify your credit scores and check for adverse credit accounts.

There is no verification of employment during the application process which is rare for mortgage programs for the purchase of a primary residence.

Frequently Asked Questions (FAQ)

What is a stated income loan?

A stated income loan is a mortgage where borrowers provide reduced documentation and qualify by using bank deposits as proof of income. Today, the program is available for those who are self employed, who are paid with W2 income, or even with no job.

Are stated mortgage loans still available?

Stated income loans are still available but not in the same format as they were before the housing bubble. Borrowers do not have to document any income at all but will need to have at least average credit scores and a solid down payment.

How much documentation is required?

You will need to document your assets which includes any bank statements, investment accounts and retirement accounts. If you are purchasing a home, you will need to provide a copy of the sales contract and later in the process proof that you have homeowner’s insurance for the property. You will not need tax returns, W2s or pay stubs.

Can I get a cash-out refinance loan?

Stated income cash-out refinance loans are available if you qualify. The basic requirements for a stated income cash out refinance are the same as the non-cash out version. Each lender may have a cap on the total loan to value ratio. We can help you to find the right lender for you.

Who are stated income loans for?

Stated income loans are for anyone who is having difficulty qualifying for a conventional or FHA loan using their income documentation. This could be a small business owner, a 1099 contractor, or a W2 employee without consistent work.

Can you get a mortgage without tax returns?

A stated income loan does not require you to qualify using your tax returns for qualification purposes but they may ask you to supply them anyway. See our article on mortgages without tax returns.

Is the program available if I receive a 1099?

1099 income earners can qualify for a stated income loan if they have their last two years 1099 to provide to the stated income lender. They also will likely have to provide copies of bank statements showing steady deposits for the lowest possible down payment.

How much would I have to put down?

The down payment requirement may vary for each stated income lender but you can expect to find a down payment requirement of anywhere from 10%-25%.

Is the interest rate the same or higher than a conventional loan?

Stated income mortgage rates are typically higher since the lender is taking on increased risk. However, they are not too much higher and in general are typically reasonable. The rates are much better than what you will find with hard money loans.

Do I need to be self-employed for a stated income loan?

You do not have to be self employed for a stated income loan. However, if you are and can provide bank statements, then your down payment may be lower.

Can I get a gift of equity to purchase a relative’s home with a stated loan?

Yes, gift funds are available for these loan programs. The stated income lender may allow you to use a gift of equity for the entire down payment amount.

Are the closing costs higher for this type of mortgage?

The closing costs may be higher with a stated income loan if the compensation is “borrower paid”. You can expect to pay 2-3 points for a stated income loan. The rest of the closing costs will be similar to a conventional loan.

Is it hard to find lenders who offer the program?

Stated income lenders are not your local bank. So from that perspective it is not that easy. You also are not going to find these programs by going to a place like LendingTree. We have been connected to the lenders who offer these programs for 15 years. You came to the right place. Just let us help you.

What states are stated income loans available in?

Stated income loans are available in all 50 states. We are connected with multiple lenders who can help in the state where you live. If you complete our contact form, we will analyze your situation and will determine which of those lenders would be the best fit for you.

Are stated loans available for investors?

Yes but the requirements are much different and there may be a prepayment penalty.

Can you buy land with a stated income loan?

There is an option to purchase raw land with a stated mortgage. The down payment will be higher than if you purchased a home.

Are stated-income home equity loans available?

Stated income home equity loans for the most part do not exist. Your best bet is to get a cash out refinance which essentially gets the job done. It is not a line of credit and you would pull out the entire amount at once.

Where can I apply online?

We do not recommend that you apply online without discussing your options first with a stated income lender. Just complete our contact form here. It is not an application but just an initial gathering of basic information to determine which stated income lender is best for you. Then, you will have a discussion with the lender and determine whether you would like to move forward with your loan.

Are stated income loans illegal?

Stated income loans are not illegal and they are available through Non QM lenders who create the guidelines and keep the loans in their portfolio after closing.

Important Facts About Stated Home Loan Programs

1. Stated income loans are a type of mortgage loan where borrowers do not have to provide traditional income documentation.

2. These loans are also known as “no-doc” or “liar loans” because borrowers can state their income without providing proof.

3. The loans were popular during the mid-2000s leading up to the housing market crash.

4. They were primarily used by self-employed individuals and those with non-traditional sources of income.

5. The interest rates tend to be higher compared to traditional mortgage loans due to the increased risk for lenders.

6. Lenders offering the program require borrowers to have a good credit score and substantial down payment.

7. Unlike traditional mortgages, stated loans rely heavily on the borrower’s creditworthiness rather than their documented income.

8. They can be faster and easier to obtain compared to traditional loans since they require less paperwork.

9. These loans often come with stricter terms and sometimes shorter repayment periods.

10. Since the financial crisis, regulations around stated income loans have become more stringent, and they are much less common today.

Related Articles

Picking the right lender – This article looks at the several different types of lenders and their risks vs benefits.

Mortgage Options for Self Employed Buyers – See what loan programs are available if you are self employed.

Questions to Ask your Mortgage Lender – Find out what you should be prepared to ask a lender when you are reviewing your mortgage options.

Jumbo Stated Income Loans – See what the largest loan amount is for you when applying for a stated income loan.

Non QM Loans – Which lenders offer Non QM loans and what are they?

We are able to help you to find a stated income loan with the best stated income lenders in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.

The History of Stated Income Loans

Qualifying for a Stated Income Loan Before The Housing Bubble

Prior to the housing crisis, it was easy to find stated income mortgages with a small down payment and poor credit. You would simply put whatever income made sense and the lender would not verify that you had the ability to repay the loan.

There were many lenders who offered the program and home buyers found themselves in trouble when they could not make the payments. This was especially true if they got themselves into an adjustable rate mortgage.

Then, the foreclosures began flooding the market with housing inventory and the result was the housing market crash.

Stated Income Loan Requirements after the Dodd-Frank Act

In response to the lax lending guidelines which contributed to the housing crisis, the Dodd-Frank Act was put in place. It essentially forced lenders to verify the borrowers had the ability to repay the loan for primary residence purchases and refinances. For about two years, the stated loans virtually disappeared.

Today, most stated income lenders require a minimum of 10-25% down or equity in the property plus a credit score greater than 600. The underwriting guidelines will also require a validation that the income you are stating makes sense.

Many people feel they need a no doc loan or a stated income loan but that may not necessarily be true. You should understand your mortgage loan options before doing anything. Then speak with a loan officer to get a free stated income rate quote based upon your particular scenario.

Other Helpful References

The Pros and Cons of Stated Income Loans – Mortgage 101

Stated Income Construction Loans – Construction Loan Center

The Mortgage Professor – Scapegoating Stated Income Loans – Washington Post

Stated Income Ruling Regarding Bankruptcies – Bankrate