Guide to Getting a Self Employed Mortgage in 2024

If you are self employed and looking for a mortgage, you may already know that you are having a difficult time qualifying for a conventional mortgage at your local bank. Most self employed borrowers cannot qualify using the traditional documentation and therefore cannot meet conventional guidelines.

This self employed mortgage guide will help you to find the right program as a self employed borrower. We can then help you to find the right lender and to get a rate quote without pulling your credit report.

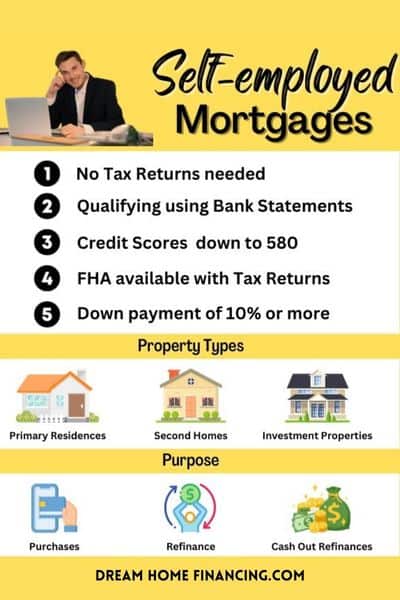

Self Employed Mortgage Requirements

Self employed home buyers can qualify for a mortgage based upon their average monthly bank deposits without having to provide tax returns.

For conventional or government loans, self employed borrowers will need to qualify based upon the net income reported on their tax returns. However, these are the guidelines to qualify for a self employed mortgage when you cannot meet the conventional or government requirements.

Requirements for a self employed Mortgage in 2024

- Self employed for at least 2 years

- Can show a flow of money coming into your bank accounts for 12-24 months.

- Minimum down payment of 5%-15% depending upon your credit score.

- Minimum credit score of 580

- Business license if applicable

These are just some of the basic requirements. If you think you still cannot qualify or have been told by other lenders that you don’t, then we can still help you. If you do not meet all of the guidelines above or have been self employed less than two years, we can still find a mortgage for you.

We can help answer any questions you may have or discuss your scenario if you are interested in finding out more. You can complete the quick contact form or call us at 732-761-9041

Credit Score Requirements for a Self Employed Mortgage

The credit score requirements for a self employed mortgage may vary by lender. However, there are a few lenders who will allow for credit scores as low as 580. Credit scores are an important factor for lenders when it comes to approving the mortgage and even assigning an interest rate. Therefore you should work hard to improve your credit score.

Self Employed Mortgage Programs

The following programs are the most common for self employed borrowers who cannot document their income.

Bank Statement Loans – These programs ask that you provide 12-24 months of your business and or personal bank statements. They want to see steady deposits (income) flowing into your bank accounts. This will be the basis for how you will be approved for the self employed mortgage. No tax returns will be required. Read more about bank statement loans.

One Year Tax Return Mortgage – The one year tax return mortgage is also for self employed borrowers. This program will help those who may have only been in business for 1 year and can qualify by providing just one year of fully documented income on their tax returns.

Best Self Employed Mortgage Lenders

There are many non-QM or portfolio lenders who offer self employed mortgages but the trick is to find the one who is the best fit for your self employment situation and with the best rates.

The self employed lenders listed below are just a few examples and their guidelines and requirements are constantly changing. We are connected to most of the national lenders who offer special mortgage programs for self employed individuals. Let us help you to determine which is best for you.

- Carrington Mortgage Services

- First National Bank

- Angel Oak Mortgage Solutions

- Citadel Servicing

- Acra Lending

How to Prepare Yourself in Advance for a Self Employed Mortgage

Consider taking the following steps well in advance of applying for a loan if you are self employed:

- Make sure that your credit score is a high as possible. There is no specific credit score requirement, but it helps with your down payment requirement and will impact your interest rate.

- Save for a 5%-10% down payment. This will be the minimum that will be required by self employed mortgage lenders depending upon your credit score.

- Deposit all business income into your bank accounts. Self employed lenders will be asking you for 12-24 months of bank statements so they can see your deposits. These deposits will be used as your income on your mortgage application. Therefore, even if you get paid in cash you should begin depositing it into your accounts.

- Speak with a self employed mortgage lender early. Even if you are just thinking about buying a home or refinancing it is a good idea to have conversations with a lender early. Let us help you to get connected to a reputable lender who can answer all of your initial questions and give you an idea as to whether you qualify and what your rate could be.

Self Employed Mortgage Rates

The lenders who offer mortgages are taking some additional risk when they allow you to qualify without providing tax returns. This is especially true when they also approve mortgages with low credit scores. The additional risk will come with slightly higher credit scores.

You can expect the credit scores for a self employed mortgage to be at least 1% higher than what you would get with a conventional loan. However, these mortgages do not require PMI when you put less than 20% down. As a result, the monthly payment may be similar to that of a conventional loan.

Self Employed Mortgage Options if You Can Document Your Income

If you are self employed and believe you can qualify using the net income on your tax returns, then there are additional mortgage options available to you:

- FHA Self Employed Mortgage – For an FHA loan, you will need to fully document your income. You cannot qualify using bank statements. Therefore, you also would follow the basic FHA guidelines that are set for everyone. There are no bank statement FHA loans. Click to read more about FHA home loans. Or you can get connected with us and we will take you through all options.

- VA Self Employed Mortgage – If you are a business owner and a veteran or active military, you can qualify for a VA loan. You will also need to qualify based upon the net income on your tax returns. There are no bank statement VA loan programs. Click to read more about VA home loans for self employed.

- USDA Self Employed Mortgage – Do you live in a rural area? If so and you can fully document your income, then consider a USDA loan. There is no down payment requirement and also no PMI. Click to read more about USDA home loans for self employed.

- Conventional mortgages for self employed – Typically, conventional mortgages required that you fully document your income and qualify the same way that W2 wage earners do. If you can document your income then you are in good shape. If not, then the bank statement loan is what you need. If you are only able to document your income but just for one year, then we have an option for you there as well.

- No Tax Return Mortgage – No tax return mortgages are very similar to a bank statement loan. No tax returns are used for qualification purposes.

Pros and Cons of a Self Employed Mortgage

Pros

- No tax returns needed

- Low down payment as little as 10%

- Your business can be losing money and you may still qualify

- There are options for people who just started in business

- Credit score requirements are lenient.

Cons

- You will need a minimum of 12-24 months bank statements

- There are no zero down programs available

- Interest rates will be slightly higher than if you can fully document your income.

Mortgage for Self Employed Less than 1 Year

If you are self employed for less than 1 year, you may still qualify for a mortgage to purchase or refinance your home. Lender are looking for income consistency for self employed borrowers. They want to be sure your business is sustainable and feel comfortable there will be income in the future to help make the mortgage payments.

There is an option if you are self employed for less than 1 year. It is a stated income mortgage which only a handful of lenders offer right now. The program is based upon your credit scores and down payment.

Read more about getting a mortgage while self employed for less than one year.

Self Employed Mortgage Related Questions

How long do you have to be self employed to get a mortgage?

Typically two years will be the minimum. However, there are options now for those who have just started their business and do not have a two year history.

How do I show self employment income for a mortgage?

When you are self employed, you will need to provide tax returns to qualify for a conventional or FHA loan. If you do not show enough income on your tax returns, then you will provide bank statements to show self employment income for a mortgage.

Is it harder to get a mortgage if you are self employed?

It can be harder if you do not have the bank statements or enough money flowing into those statements to qualify. The real difference will come down to what the terms of your mortgage will be.

Do Banks offer Self Employed Mortgages?

Lets first identify a bank as your traditional bank in your neighborhood where you can open a savings account. The majority of these banks do not offer a self employed mortgage program.

How do you qualify for are self employed mortgage?

If you can document your income, then you will qualify the same as W2 wage earners. If you cannot document your income then you are most likely going to qualify with a bank statement loan. We work with quite a few lenders who specialize in bank statement loans for self employed borrowers.

Where can I find self employed mortgage lenders?

These lenders are not always easy to find and they all have different guidelines. For example, some will require a larger down payment than others. Some only do business in certain states. Others require only 12 months of bank statements. These self employed mortgage lenders are not your local bank like Bank of America or Wells Fargo. Instead, they are specialized lenders that are not easy to find. This is why you should let us connect you with the one that makes the most sense based upon your scenario.

Are self employed mortgage lenders reliable?

They are absolutely reliable. These are not lenders that have a brick and mortar building in every town and they are not a traditional bank where you can keep deposits and have a safe deposit box. These are lenders who specialize in mortgages, are government approved, and have creative programs that your local bank does not have.

What kind of professions qualify for a self employed mortgage?

The most common professions are realtors, contractors, restaurant owners, massage therapists, plumbers, electricians, attorneys, masons, store owners, and more. If you are in business for yourself for a minimum of two years and have sufficient bank deposits, then you can get a mortgage.

Are there cash out refinance mortgages for self employed?

Yes, you can absolutely cash out but the maximum loan to value ration will vary based upon the loan program and also whether you can document your income.

What is a self employed mortgage advisor?

A self employed mortgage advisor will help self employed individuals to prepare themselves in advance of applying for a mortgage. The advisor will help identify the documents needed to apply for a self employed mortgage, then can help them to find the best self employed mortgage lenders.

Can you get a mortgage with just one year of tax returns?

Yes, there are programs for just one year of tax returns. There are just a few self employed mortgage lenders who offer that program.

Can you qualify for a mortgage with seasonal income?

If you are self employed with seasonal income such as a landscaper or fishing charter business, you can still qualify for a self employed mortgage. When lenders ask for 12-24 months bank statements, they are going to look at your average monthly deposits. This take seasonality factor out of the equation and will help you to qualify.

We are able to help you to find a self employed mortgage lender in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.