No Documentation Loan Options

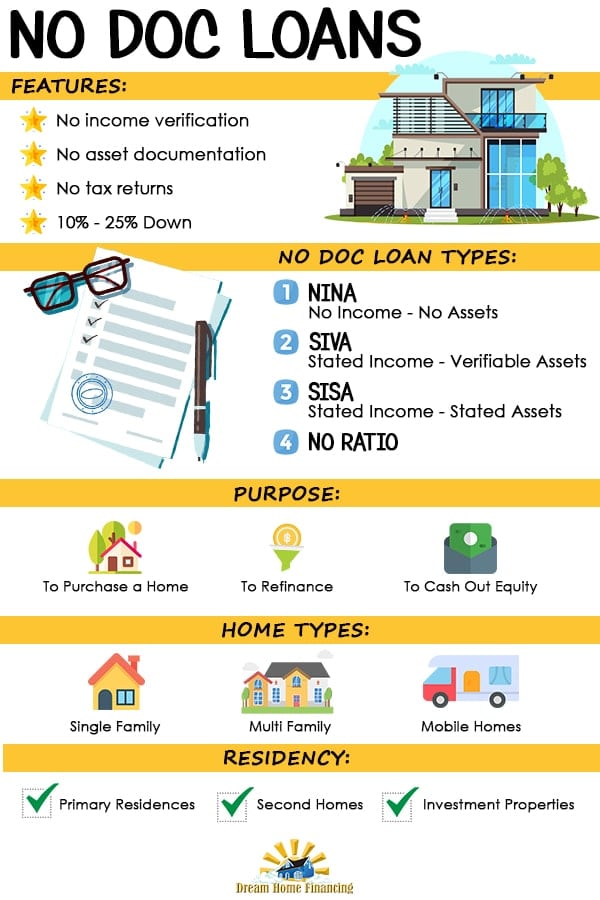

No Doc Loans provide increased ease and privacy for borrowers who sometimes have difficulty documenting their income. No doc loans do not require borrowers to provide income documentation and very little asset documentation to qualify for a mortgage.

No-doc loans are available for individuals who are self employed and have difficulty qualifying using tax returns. They can be used for the purchase of a primary residence or for investment properties.

A question that many people are asking is what are my 2024 No Document loan options? The program was extremely popular 20 years ago. However, after the mortgage crisis most of the programs were eliminated. The good news is some no doc programs have returned providing some opportunities to purchase a home with limited to no income documentation.

We have helped home buyers and homeowners finance their properties with no doc loan options for more than 20 years. Please feel comfortable trusting us to find the right mortgage program for you in all 50 states by contacting us to have a confidential discussion. We can review your mortgage scenario and will let you know what your options are without pulling your credit.

No Doc Loan Requirements

These are the basic no doc requirements and they may vary based upon your credit scores and loan scenario.

- Minimum of 10% – 25% down

- Provide only your bank statements

- Property can be your primary residence, second home, or investment property

- We can work with lower credit scores

- No tax returns needed

- For investment properties, no documents will be needed at all

Click to get help with a no doc loan or call 732-761-9041

No Document Loan Benefits

No doc loans, low doc loans, stated income loans, NINA, no ratio loans and bank statement loans are commonly used to meet the needs of various employment and income situations and they are available in 2024.

The more documentation you provide to your no doc lender with your loan application, the lower your interest rate may be. Many home buyers cannot provide documentation for personal or tax reasons and are thankful to have no doc loans as an option. Many of these home buyers also have a healthy income, savings, or credit history.

A No Doc Loan or Low Document Loan provides increased ease and privacy when applying for a mortgage.

In the past, anyone could apply for a no doc loan but now this type of loan is designed for self-employed borrowers. No doc loans are also available to investors who may not be self employed.

Borrowers that opt for a No Doc Loan are typically those who do not prefer to have their income documentation and financial history presented to the lender.

For instance, they might be using inheritance to secure a loan or have fluctuating income from owning their business. They also may not qualify as a self-employed borrower if they had to do it based upon the income on their tax returns.

Ease is a big factor as well because with a no doc loan, the borrower provides minimal amounts of information and documentation. With a true no doc loan, you will provide their social security number, current address, and documentation about the property they plan to purchase.

Eligibility and Documentation Requirements

Companies that offer no income verification loans have different eligibility and qualification requirements than conventional or FHA loans. While there are reduced documentation requirements, lenders often look for better credit scores and higher down payment amounts.

Credit Score Requirements – The lowest credit score possible for a no doc loan at the moment is 580. The higher the credit score, the lower the down payment. Lenders are often changing their credit score requirements based upon market conditions.

Down Payment Requirements – The lowest down payment possible is 15% and with poor credit all the way up to 30% down. The down payment is the only collateral that lenders look for. You cannot pledge equity from another property.

Documentation Requirements – The required documents will vary based upon the “type” of no doc loan that you apply for. There are no loans where you supply no documents at all. What they have in common are no requirement to supply tax returns or W2’s. In some instances you may be required to provide bank statements. In all cases you would need to provide a copy of your sales contract if you are purchasing a home. If you are refinancing you will be asked for a copy of your current mortgage statement. Prior to close, you must provide documentation that proves the property has homeowner’s insurance coverage. It is still much less paperwork than a conventional loan.

Types of No-Doc Loans and Low-Doc Loans

There are a few types of no doc loans available depending upon your specific scenario. You may qualify for one or more of these and the terms will likely be different for each.

Bank Statement Loans

Bank Statement Loans are for self-employed individuals only. No Doc Lenders will ask you to provide 12-24 months bank statements. Only the bank statement deposits will be used for qualification purposes.

The average monthly deposits will be used to qualify you for your mortgage. They will take a percentage of those deposits and those dollars will be treated as income on the loan application.

The good news is that all of the legitimate tax deductions that you are taking for your business will not be used against you like when you apply for a conventional loan. Bank statement loans are the best option available to you now.

The minimum down payment for this program is 10% and will be based upon your credit score. Interest rates will be higher than conventional loans.

Stated Income Loans (Low Doc Loans)

Stated Income Loans or Low Doc Loans typically attract people who work on a cash or commission basis or people who do not draw a consistent salary. The borrower will not need to disclose earnings and might not need to show tax returns or bank statements.

Stated income loans allow borrowers to simply state what their income was on the loan application, but do not have to provide any proof of that income. This means no pay stubs, tax returns, or W2s. In some instances, salaried borrowers may qualify for a stated income loan.

The minimum down payment now for a stated income loan is 10% and your credit score will be the determining factor. Read more about stated income loans.

No Ratio Loans

No Ratio mortgage loans are for borrowers who may also be a W2 salaried employee but do not wish to disclose their income. With this loan, there is no debt-to-income ratio for the lender to evaluate.

This loan can be a quick and easy process for borrowers that would have difficulty proving their income.

The typical No Ratio borrower has good credit and abundant assets that make up for the lender not requiring the borrower’s income information to be measured.

This mortgage comes with a slightly higher interest rate and a minimum down payment of 20%

Update – No Ratio Loans are available but down payment requirements have recently changed.

No Income No Asset Loans (NINA)

No income no asset loans (also called NINA loans) are for self employed people who do not or cannot disclose both income and assets. NINA loans are also for borrowers whose income and assets are typically not sufficient to qualify for a loan. In this case, the borrower will need to have good credit.

NINA loans will also be quick and easy to process because neither your income nor your assets are documented on the loan application. Recent lending guidelines have limited the availability of NINA loans for primary residences and you are likely to find lenders who offer this for investment properties.

The down payment requirement for a NINA loan starts at 20% for both primary residence and investment properties.

No Documentation Refinance

There are lenders who offer a no doc refinance to borrowers who cannot document their income or assets. The rates will be similar to what you would get if you were purchasing the home. However, a no doc cash out refinance may be limited to the lender’s maximum loan to value ratio which today is up to a maximum of 75%.

No Documentation Rate and Term Refinance

If you are refinancing simply to get a lower rate, change the term, or to remove someone’s name from a mortgage, you can likely refinance your current mortgage balance.

The maximum loan to value ratio may be up to 90% of the appraised value with a no doc rate and term refinance.

No Doc Cash Out Refinance

If you are looking to cash out equity, you can apply for a no doc cash out refinance. Your credit scores, appraisal amount, and property type will determine how much you can be approved for.

Most lenders who offer a no doc cash out refinance will cap the program at a 75% loan to value. It will require an appraisal and if you purchased the home less than 12 months ago, you may need a lender with no seasoning requirements.

No Doc HELOC – Home Equity

A popular way for homeowners to access the equity in the home is with a HELOC. (home equity line of credit). The difference between e HELOC and a home equity loan is with a HELOC you are getting a line of credit that you can draw on if needed, but a home equity loan requires you to take all of the funds at closing.

A no doc HELOC is extremely rare at this point because the lenders who offer no doc loans are unable to profit effectively with the HELOC product. As a result, you will find it easier to gain an approval for a cash out refinance or even a second mortgage if the loan amount is large enough.

If your home is completely paid off and you would like to cash out equity, a no doc cash out refinance may be the better option versus a no doc HELOC. That said, your current mortgage rate may be low which could make a complete refinance costly. Let’s talk about your current situation with the equity and rate that you may have and come up with a plan that works for you. Contact us here.

No Document Required Investment Loan

No doc loans today exist to help finance investment properties with no job or income documentation required. The lenders are simply looking at your credit scores, down payment, and whether the property will be cash flow positive.

In most instances, a no-doc investment loan can be done with as little as 20% down. You may find then in an interest-only option with 30-year financing. Read our article on investment loans to learn more about the program. If you are ready to get pre-approved for a no doc investment loan now, then simply contact us.

Interest Rates and Terms

Companies that offer reduced documentation loans will have higher interest rates than traditional mortgages. Due to the increased risk when providing either no, or little documentation, the rates will be 1-3% higher than conventional rates.

The mortgage rates offered are also tied closely to your credit scores and down payment. The more you put down and the higher your credit scores, the lower your interest rate will be. Therefore, these two factors are most critical if your goal is to get the lowest rate possible. Keep in mind there is no PMI associated with these loans so if you are able to put less than 20% down, you will have that savings in your mortgage payment.

The repayment terms offered are typically a 30 year fixed mortgage. It may be possible to get an adjustable rate in exchange for a lower interest rate. There are typically no prepayment penalties for financing primary residence, but for investment properties the lender may have a prepayment penalty requirement.

Pros and Cons of No Documentation Mortgages

Like any type of mortgage, no documentation mortgages come with their own set of pros and cons that borrowers should consider before applying:

Pros:

- Simplified application process without extensive income documentation requirements.

- Potential for faster approval and funding compared to traditional mortgages.

- May be suitable for self-employed individuals or those with irregular income sources.

Cons:

- Tend to have higher interest rates compared to conventional mortgages.

- Often require larger down payments or higher credit scores to offset the increased risk.

- Borrowers may face limited options as the availability of no documentation mortgages has decreased in recent years.

Understanding the basics of no documentation mortgages is essential for borrowers considering this type of loan. It is crucial to carefully assess the pros and cons, evaluate personal financial circumstances, and explore alternative mortgage options before making a decision.

Alternatives to No-Doc Loans

There are two most prominent alternatives when financing a property. The first is going with a private lender who may not have specific lending requirements. This could just be anyone within your circle who has money to lend. In those instances, you simply work out the terms and sign a note. This individual is now your lender.

The other alternative is to put yourself in position to get approved for a fully documented loan which would offer you the best possible terms. This could mean waiting to have the work history, filing your tax returns, or even waiting on a bankruptcy to season.

Bottom Line – No Doc Loans

To find out whether a no doc loan is right for you, contact us or complete the free quote form and we will get back to you to discuss your options free of charge.

In a recent article by CNBC, they tell us that some banks require few mortgage documents. In this case, they are calling it a Light Doc Loan where the bank does not have to comply with the Dodd Frank ATR or ability to repay rule.

*If you are looking for a no doc loan and you have bad credit, we can still help you even if your credit scores are as low as 580.

No Document Loans – No Doc Loans (FAQ) Frequently Asked Questions

Q: are no doc loans still available?

A: A true no doc loan for primary residences is difficult to find. However, the best option available today is a bank statement loan for self-employed people. With just 12-24 months of bank statements, you will be able to purchase a home.

Q: Can anyone get a no doc loan?

A: Anyone can get a no doc loan but the credit score requirements and the down payment will be higher. Most of these loan programs today are available for self-employed individuals.

Q: Can I refinance a no-doc loan without proof of income?

A: You can get a bank statement loan which only requires you to provide 12-24 months of bank statements or an investment no doc loan without any proof of income.

Q: Do all lenders offer no documentation loans?

A: Most lenders do not offer no doc loans, but we are able to help provide you with the best options for your scenario.

Q: What if I cannot provide tax returns to prove my income?

A: You do not need to provide tax returns if you have the ability to provide bank statements to prove your income. You still may be asked to provide tax returns or tax forms but they will not be used for qualification purposes.

Q: Can I get a no document cash-out to refinance the loan?

A: You can get a no doc cash-out refinance loan and most lenders offer these programs with a specific maximum loan to value ratio of up to 75%.

Q: Which lenders offer no document loans?

A: Although most lenders do not offer no doc loans, there are a few portfolio no doc lenders that offer these programs. We have been able to help with no doc loans for the past 15 years.

Q: Can first-time home buyers get a no document loan?

A: First time home buyer can qualify for a no doc loan if you are able to meet the minimum qualification requirements for the program.

Q: What is a bank statement loan?

A: It is a loan for self-employed individuals who need to use average monthly bank deposits to qualify for a mortgage rather than using the net income from their tax returns.

Q: Can I get a no-doc home equity loan?

A: There are just a few lenders that offer a no-doc home equity loan or HELOC. If you are self-employed and cannot document your income, It may be possible to get a HELOC, a home equity loan, or a cash out refinance of your primary mortgage.

Q: What is a non-QM Loan?

A: Non QM stands for Non-Qualified Mortgage Loan. A qualified mortgage is one that meets the standards set by the federal government. Unfortunately, many people do not qualify for those loans due to their not so unique situations. Therefore, non-QM loans such as bank statement or stated income loans are available.

Q: Are no doc or no document loans available with no money down?

A: No-doc loans have always required a down payment of at least 10%. If you need a no money down loan, then you will have to qualify for a mortgage using your tax returns and income documentation.

Q: What is the “ability to repay rule”?

A: It is a rule that requires lenders to do their best to make sure that borrowers have the ability to repay the loans they are applying for. This becomes even more important when they are applying for a reduced documentation loan. This is also called the ATR/QM rule.

Q: What debt to income ratios are used for a no doc loan?

A: Typically, lenders are using ratios of about 43% for these loans. However, we with with high DTI lenders who will allow for DTI ratios as high as 55%. For no ratio loans, the DTI will not be factored at all.

Q: Are there mortgages for people with no job?

A: There are programs for people with no employment when purchasing investment properties. The minimum down payment would be 20% with good credit.

Q: Where can I find a self employed lender?

A: There are a handful of lenders who specialize in lending to self-employed borrowers. We can help you to get connected.

Q: Can I get a mortgage with no tax returns?

A: Yes, there are mortgages available with no tax returns required but they are only offered by certain lenders. Read our article on no tax return mortgages to learn more.

Q: Do I need a down payment for a no doc loan?

A: There larger down payment requirements when you provide less documentation. You should expect the down payment to be a minimum of 10%-25%.

Q: How long does it take to get approved for a no doc loan?

A: You can get a basic pre-approval within 24 hours after completing the loan application. A full approval will be just a few days after your loan application is submitted to underwriting.

Q: How do lenders verify income for no doc loans?

A: The income verification process will vary based upon the type of loan. If you are self employed, the lender may verify income based upon your bank statements. If you are buying an investment property, then the lender will use the proposed rental income.

Q: Where can I find lenders that offer no-doc-loans?

A: Most traditional or local banks do not offer these loan programs. In fact, many of the lenders who do only work through a broker network and are not offering direct to consumer options. We can help finding a lender by completing this short request form.

Facts and Statistics about No-Document Loan Options

Related Articles

What Others are Saying

Trulia – No doc or stated income loans are making a comeback and this is huge for self employed borrowers.

American Banker – One of the best things for the lending business has been the bank statement loan for self-employed individuals.

History of What Happened to No Documentation Loans in the Past?

Prior to the housing bubble, anyone could get a loan without providing any income documentation. Basically, all you needed was an address and a signature.

Legislators forced banks to offer loans that would help more people to be able to purchase a home. In fact, there were fines if the lenders did not offer these loans. The lenders compiled and provided these loans but they sold them off in bundles as investments.

When people started to foreclose, the loans defaulted and the investments failed. This resulted in the mortgage meltdown of 2008. Politicians blamed the lenders and interestingly enough they did not blame the big banks but instead, they blamed mortgage brokers.

What happened next was the lending guidelines tightened. All of the creative loan programs disappeared and gone were no doc loans, stated income, options arm loans, etc. Some lending institutions even went out of business. A few examples are Indy Mac bank and Countrywide for example that specialized in no doc loans are gone now.

After a few years of mortgage darkness, some of the creative programs such as bank statement loans started to come back again. Now, we have enough options to help people who cannot qualify for a conventional loan.

We are able to help you to find a no document loan with the best no doc lenders in the following states:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming