Bad Credit Mortgages – Bad Credit Mortgage Lenders

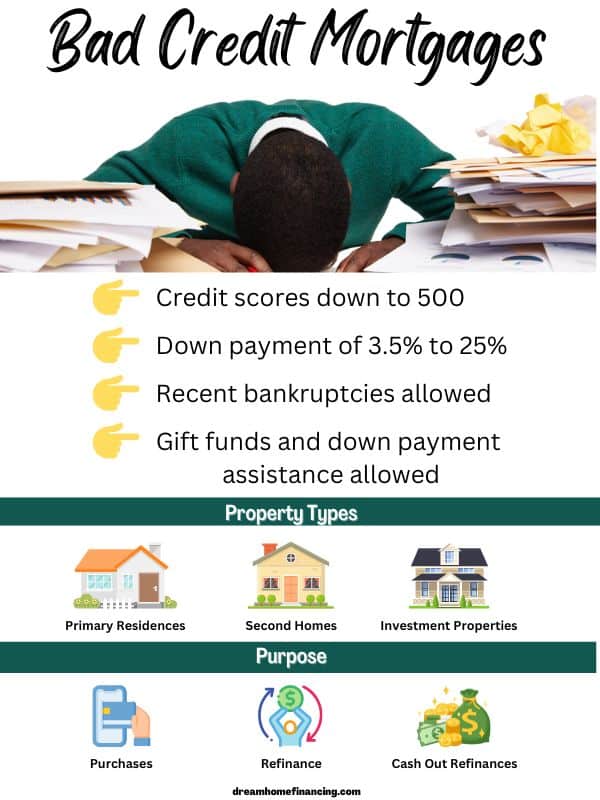

Updated October 23, 2024 – Bad credit mortgages are available with credit scores starting at 500 and with a down payment as low as 3.5%.

A bad credit mortgage is one where the home buyer can get approved despite having low credit scores but with other positive compensating factors.

Lenders who offer mortgages to individuals with poor credit are taking on some additional risk and as a result, the interest rate may be slightly higher than what you would be offered with excellent credit.

There are a lot of reasons why you may have poor credit but what is most important now is how we can help you to get a bad credit mortgage by understanding your scenario, and finding the best bad credit mortgage lenders to help.

Please begin by completing the request quote form and someone will have an initial discussion with you without pulling credit.

Bad Credit Mortgage Scenarios

One or more of these scenarios below may apply to you which could be making it difficult to get approved for a mortgage.

- You have low credit scores and cannot qualify for a mortgage with other lenders.

- You have a bankruptcy or foreclosure.

- You have late payments on your existing or prior mortgage.

- You want to consolidate your bills into one low monthly payment.

- You need relief from the harassing calls of creditors.

- Temporarily unemployed or in between jobs?

If the answer is “yes” to any of these scenarios or if your credit score is less than 620 or even as low as 500, then you may still qualify for a mortgage.

Please take a moment to complete the contact form and a professional loan officer will provide you with a free personal consultation to see what makes the most sense for you.

Bad credit mortgage chart

| Mortgage Type | Minimum Credit Score |

| FHA | 500 |

| VA | 500 |

| USDA | 500 |

| Subprime – Recent Bankruptcy | 600 |

Bad Credit Mortgage History

Up until the housing bubble over a decade ago, finding bad credit mortgages was extremely easy. In fact, you could get a mortgage with bad credit or without having to document your income. Those days are over but there are still options if you are able to document your income.

What is Bad Credit when Applying for a Mortgage?

From a lender’s perspective, any score below 620 is considered to be bad credit and this is when it becomes more difficult to get approved for a mortgage. Virtually all of the large banks only want customers with the best credit.

The government loans such as VA, FHA and USDA have either a low credit score minimum, or no credit score requirement at all. The problem is most lenders are not accepting low scores and finding a lender who is willing to work with you can be difficult.

If your credit score is just high enough to qualify for a mortgage, it could also be low enough to result in a less than optimal interest rate. Lenders have a matrix they refer to when determining your mortgage rate. Part of that matrix includes adjustments for credit score. The lower your credit score, the higher your interest rate.

Bad credit is not just about the credit score. If you had a credit event such as a bankruptcy or foreclosure, lenders will put you into the bad credit category even if your credit scores are not bad.

We have experience with customers who had a bankruptcy but somehow their credit scores were over 680. Despite the score, the recent bankruptcy means they will not qualify for a conventional mortgage, and possibly not even an FHA loan.

If you have some time, the best option would be to learn how to improve your credit score. Reading through that page will help you to improve your credit score on your own. It will also show you where you can check your credit score to know exactly where you stand. This will open up the most loan options for you and will also help you to get the best mortgage rate.

If you do not have time to improve your credit scores, then we will share how you can find a bad credit mortgage right now.

How to Qualify for a Bad Credit Mortgage

Qualifying for a mortgage with bad credit will vary depending upon your credit score, your employment status, and whether you have had a bankruptcy or a foreclosure within the past two years. Here are the basic qualifications for a bad credit mortgage:

- Credit Score – The lowest credit score allowable is 500

- Down payment – The minimum down payment will be 3.5%-10%. This down payment will be for virtually anyone whether you are self employed or if you are a W2 wage earning looking for a bad credit FHA loan. If you had a recent bankruptcy or foreclosure, then your minimum down payment will be 25%.

- Income Requirement – W2 wage earners will need to provide your last 30 days pay stubs as well as your W2s and tax returns. If you are self employed and cannot document your income, then you will need to provide 12 months bank statements.

- Bank Statements – For a W2 wage earner, you will need to provide a minimum of 2 months bank statements. For self employed individuals, you will need 12 months bank statements. Some lenders may require more depending upon the strength of your application.

Compensating Factors For a Bad Credit Mortgage

Here are some of the compensating factors that will come into play when trying to qualify for a bad credit home loan. The more you can add to your mortgage application, the stronger an application it will be and more likely to get approved.

- Larger Down Payment – This helps to reduce the risk for the bad credit lenders. It shows more of a commitment on your part and provides a safety net in the event of a foreclosure. If the bad credit loan program you are interested in requires only 10% down but you are able to put down 25%, then that is a huge positive for you.

- High Income Stream – Higher income helps because it tells the lender that although your credit scores are bad, you do have the money to make the payments. One of the key elements when underwriting a loan is determining a borrower’s ability to pay so this is important. If you are self employed with bad credit and you cannot fully document your income, then you should read about stated income loans.

- Low Debt to Income Ratios – This means that your monthly obligations (all payments on your credit report + your new proposed mortgage payments) divided into your gross monthly income is less than 40%. Many of the bad credit lenders will allow your ratios to be as high as 50% – 56.9%. If you have bad credit and your debt ratios are high, you can still get a mortgage.

- Cash Reserves – After your down payment and closing costs, the more months of cash reserves you have the better your chances to have your loan approved. Knowing that you have a minimum of 6 months of reserves is a positive compensating factor. According to Dave Ramsey, your reserves really should be much greater than 6 months as part of a strategy to achieve financial freedom. When bad credit lenders look at your loan application, they will use reserves as one of the compensating factors because it helps to minimize their risk.

- Steady Employment History – Working in the same place for a long time is another positive thing to bad credit mortgage lenders. Conversely, if it looks like you are constantly bouncing from one job to the next or you have periods of unemployment, then this could be a problem. You will usually need a minimum of a two year work history either in a job or two years in your own business. However, it is possible to still get approved if you changed jobs within the past year.

- Rental Payment History – Showing that you have a good rental payment history by providing a letter from your landlord is a positive thing. In addition, if your new proposed mortgage payment is similar to what you were paying in rent, that is also a positive. Lenders want to avoid “payment shock” which is when you go from one monthly payment to a much larger monthly payment in your new bad credit mortgage.

Bad Credit Mortgage Programs

Here are the bad credit mortgage programs that may fit your situation. After talking to one of our bad credit lenders, you and the qualified loan professional can decide what makes the most sense.

- Bad Credit FHA Loans – An FHA loan is what we would suggest first. It would provide an opportunity to qualify with a bad credit score while also maintaining a reasonable interest rate. Typically, an FHA loan would require only a 3.5% down payment for scores as low as 580. However, if your score is 500-579, then you will need a 10% down payment for a bad credit FHA loan. Keep in mind that although those are the standard credit score requirements, not many lenders offer bad credit FHA loans for scores less than 580. However, we can help you. Read [FHA Mortgages.]

- VA Home Loans – Veterans may be able to qualify for a VA home loan. This is just one of the many well deserved benefits of serving our country. Although the Veterans Administration does not have a credit score requirement, many lenders impose their own credit score minimum of 620 or more. In the past, we have found a few lenders who will go as low as a 500 credit score so yes we can help you.

- USDA Rural Development Loans – More than 90% of the US is considered to be a USDA eligible rural location. Therefore, it would be a good idea to check your location for USDA Eligibility. You can find a USDA home loan with 100% financing. However, many lenders are asking for higher credit scores when there is no down payment. We can also help you to a bad credit USDA loan with credit scores as low as 500.

- Down Payment Assistance – Grants – There is a chance that you may be eligible for a federal grant or down payment assistance. That information resides on the HUD assistance programs page for more info. Just click on your state and then “assistance programs”. Lots to read there and you may need to make some phone calls.

- Down Payment Gifts – If you do not have the funds for a down payment, there are a few programs including FHA will allow for you to receive the funds needed as a “gift” from a relative. They would only need for you to provide a gift letter and the funds will need to be transferred to you prior to closing.

- Recent Bankruptcy or Foreclosure – We receive a lot of requests from individuals who have had a bankruptcy or foreclosure. They want to purchase a home or refinance a current mortgage but do not know how to approach it. The reality is that if you had a bankruptcy or foreclosure then your credit scores are probably going to be low. Read [mortgage after a bankruptcy]

For a government loan such as FHA, there is a waiting period before you can qualify for that loan after a bankruptcy or foreclosure. However, there are exceptions which can be made to shorten the waiting period. We suggest speaking with one of our FHA lenders to see if you do qualify.

Refinancing with Bad Credit

If you have bad credit and you need to refinance, there is help for you as well. Most of the programs mentioned above can also be used for a bad credit mortgage refinance. However, there are two programs below which are available only for refinancing.

Your best option would be an FHA Streamline Refinance. This program is eligible for individuals who already have an FHA mortgage on their homes. The FHA streamline refinance program does not require a credit check or income verification. This means you can get approved and also secure a competitive rate. It is important though for you to have been making payments on time with your existing FHA mortgage.

Regardless of what type of mortgage program you have now, you have a chance to refinance with bad credit. If you are looking to cash out, an FHA loan will permit you to refinance up to 80% of your appraised value. That is the highest loan to value ratio available when cashing out with bad credit.

Bad Credit Mortgage Lenders

There are just a handful of lenders who are willing to work with people who have bad credit. Most of these are wholesale lenders who work through a broker network and not direct to consumer. The guidelines, requirements and what they are willing to work with is constantly changing.

The bad credit mortgage lenders below currently have the ability to help those who are looking for a mortgage with poor credit. Some can help with FHA loans, VA loans, recent bankruptcies, or for self employed individuals who cannot qualify using tax returns.

EPM Wholesale – EPM can help with FHA, VA, USDA, Conventional, recent credit events, and also self employed.

Carrington Wholesale – Carrington is offering FHA (including 203k rehab), VA, USDA, Conventional, and also self employed

REMN Wholesale – REMN is a wholesale lender who offers FHA, VA, USDA, Conventional, bank statement loans, and also asset based mortgages.

AFR Wholesale – AFR Wholesale offers various programs and has a focus on FHA. This includes the 203k rehab loan and also the FHA One Time Close Construction loan which is very hard to find.

These lenders are working through a broker network. Please complete this short loan scenario form and one of the authorized broker representatives will contact you to discuss your options without pulling credit.

First Time Home Buyers with Bad Credit

First time home buyers often attempt to apply for their first mortgage with already having bad credit. This means their credit history was negatively impacted by credit events unrelated to a mortgage. They possibly had late payments on consumer debt such as credit cards or possibly had a medical collection issue.

First time home buyers can still get approved for a bad credit home loan. Some of the programs referenced above fit perfectly for first time home buyers with bad credit. Just contact us here to see if you qualify.

FAQ Getting a Mortgage with Bad Credit

Do I need to improve my credit score before applying for a bad credit mortgage?

You don’t have to improve your credit score before qualifying for a bad credit mortgage. However, doing so will make it easier and will most likely result in a better interest rate. Everyone’s situation is different so give us a call so we can help figure it out for you.

Can you have a 500 credit score and buy a house?

You can purchase a house with a 500 credit score and a 10% down payment. The score itself is not going to be the determining factor. The lender will also review everything on your report and may ask you to remove disputes or to pay off collections.

Should I apply for a bad credit mortgage now or wait until my credit scores improve?

You will absolutely get a better mortgage rate and possibly a lower down payment with excellent credit. However, it can take time to repair and improve your credit scores. So, if you are ready to buy or have found your dream home, you can always get a bad credit mortgage now and then refinance later when your scores improve.

Are there flexible down payment options for people with bad credit?

You can find some of the loan programs referenced above. FHA, USDA, etc. Anywhere from 10% down to ZERO down. In addition to those government programs, there are lenders who will approve your mortgage with a bankruptcy with a small down payment.

Can First Time Home Buyers Find a Bad Credit Mortgage?

The programs outlined above apply for first time home buyers with the exception of the FHA streamline refinance because… well you need to be a homeowner first before you can refinance! It is common for first time home buyers to have bad credit.

Are There Bad Credit Mortgages For Those With a Credit Score Under 600?

There are programs for scores under 600 and the one that may make the most sense would be an FHA loan. We are able to help you to get a mortgage if your score is as low as 500. However, the lower your credit score, the higher the down payment requirement will be.

Are Bad Credit Mortgages Hard Money Mortgages?

Bad credit mortgages are not hard money. You will be working with national lenders who are leaders in the industry. They are not hard money lenders.

We are able to help you to find you a bad credit mortgage lender in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.

Related Articles

Learn about some of the reasons why you can’t get a mortgage? from Kyle Hiscock

Paul Sian talks about the various Mortgage Scams to watch out for.

Michelle Gibson describes the ways how financing can ruin your home purchase.

Read about the various first time home buyer struggles from Geoff Southworth

We can help you to purchase or refinance your home with the following credit scores…

500, 505, 510, 515, 520, 525, 530, 535, 540, 545, 550, 555, 560, 565, 570, 575, 580, 581, 582, 583, 584, 585, 586, 587, 588, 589, 590, 591, 592, 593, 594, 595, 596, 597, 598, 599, 600, 601, 602, 603, 604, 605, 606, 607, 608, 609, 610, 611, 612, 613, 614, 615, 616, 617, 618, 619, 620. 621, 622, 623, 624, 625, 626, 627, 628, 629, 630, 631, 632, 633, 634, 635, 636, 637, 638, 639, 640, 641, 642 643, 644, 645, 646, 647, 648, 649, 650, 651, 652, 653, 654, 655, 656, 657, 658, 659, 660, 661, 662, 663, 664, 665, 666, 667, 668, 669, 670, 671, 672, 673, 674, 675, 676, 677, 678. 679, 680