Mortgage After Foreclosure

At least 700,000 homeowners lose their homes to foreclosure every year. Despite this unfortunate setback, people need to find a place to live and eventually will try to purchase a home again. Getting a mortgage after foreclosure is going to take special loan program from a subprime lender to help make this happen for you.

If you recently had a foreclosure or if you are close to being foreclosed upon in the near future, there are mortgage after foreclosure options for you. We specialize in helping people who are dealing with a difficult foreclosure and there is a good chance we can help you too. Simply complete the short contact form and we will call to discuss your scenario.

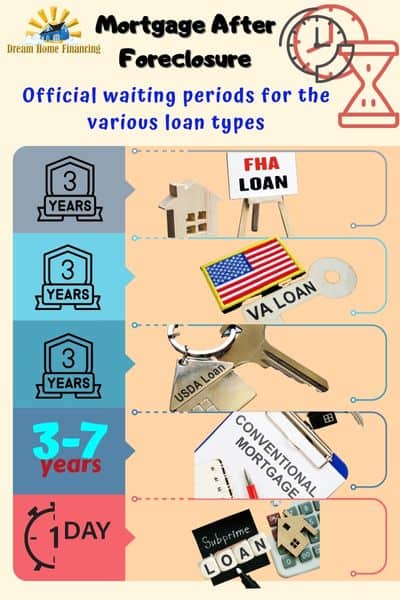

Waiting Periods to Apply for a Mortgage After a Foreclosure

These are the official waiting periods for the various loan types before you can apply for a mortgage after a foreclosure.

- Conventional Loan = 3-7 years

- Subprime Loan = 1 day

- FHA Loan = 3 years

- VA Loan = 3 years

- USDA Loan = 3 years

*Some of these waiting periods can be reduced if you have extenuating circumstances. Some examples of extenuating circumstances which may help reduce your waiting period are military service, death of a spouse, and identify theft. You would need to provide documentation and each scenario would have to be reviewed before being approved.

Qualifying for a Mortgage One Day After a Foreclosure

If you have a foreclosure in your history and would like to qualify for a mortgage, you will be looking at a subprime loan. Here is what you need to know.

- You will need a minimum credit score of 500 depending upon the loan program

- A down payment of up to 20% may be required. Your credit score will be the deciding factor

- Wage earners will have to document their income

- Self-employed borrowers may qualify using bank statements

- You will need to document your liquid assets

These are just the basic requirements for a subprime loan and the requirements may be different for you. Let us help you to determine whether you qualify.

Lenders Who Can Help with No Waiting Period After a Foreclosure

The following subprime lenders offer programs that can help you to qualify for a mortgage just one day out of foreclosure. The programs these lenders offer are not governed by Fannie Mae or any of the government guidelines such as FHA, VA or USDA. As a result, they do not have the mandatory waiting periods like those other programs do.

First National Bank of America – FNBA can provide you with financing just one day out of foreclosure. They are licensed nationally and are headquartered in Michigan. They recently increased their credit score minimums to 600 which means you will have to work hard to increase your credit score coming out of a bankruptcy to meet those minimums. They will also require a down payment that may be a bit more than the other lenders depending upon your credit score.

Caliber Home Loans – Caliber has a mortgage product that they call their Fresh Start Program. It is specifically designed for individuals who had a recent foreclosure, bankruptcy or short sale. Their credit score minimum is 580 but they can also help if you have no credit score at all. The minimum loan amount is $100k and the maximum is $1 million. They offer both fixed and ARM products and claim to have a low down payment option. Your minimum down payment requirement will likely be tied to your credit score.

Angel Oak Mortgage Solutions – Angel Oak can help if you are just one day out of foreclosure and they have a maximum loan amount of $1 million. Meanwhile, they have been raising their loan amount minimums and they are not licensed in every state so you will need to contact us to see if Angel Oak is the right lender for you. Their credit score minimums are 500 which is a huge plus and if you have higher credit, the down payment minimum would be just 10%. Finally, they may allow up to a 50% DTI and a 6% seller concession on purchases.

Carrington Mortgage Services – Carrington offers a nice combination of allowing for low credit scores and lower down payment requirements. They can help with your mortgage just one day out of a foreclosure and their loan amount minimum will be $100k. Carrington has both a wholesale and a retail division. Although their minimum down payment is just 10%, that is with a credit score of at least 700. If you have a recent bankruptcy then chances are that your scores are lower and the down payment requirement will be a bit higher. Carrington is also licensed in all 50 states.

Keep in mind this is just a small sampling and it could be that none of these are the right lender for you. We can help determine which lender out there is best suited to help with your specific situation. This is going to be extremely helpful for you since the guidelines change often and as a consumer, it is nearly impossible to find every option out there. So, let us help you.

Click to find out if you qualify for a mortgage after a foreclosure

Applying for an FHA Loan After a Foreclosure

FHA loans have strict guidelines when it comes to foreclosures. There is a high level of risk for the lender because the down payment is so small and there is already a history of the borrower’s inability to make the mortgage payments.

The waiting period to apply for an FHA loan after a foreclosure is going to be 3 years unless you can get an exception due to an extenuating circumstance (see below for examples). The ability to get the exception is rare but if successful, the waiting period would only be one year.

You will need to me the other standard requirements for an FHA loan despite having a foreclosure in your history. Keep in mind that one of those requirements is to have no recent late payments on any mortgage.

There are other options to purchase or refinance a home during of after a foreclosure. The product is a foreclosure bailout loan which will help to save your existing home or to purchase a new one. Read more about foreclosure bailout loans.

Applying for a VA Loan After a Foreclosure

Similar to an FHA loan, VA loans also have a 3 year waiting period. You will need to show improvement in your credit and payment history since your foreclosure. All of the other basic requirements for a VA loan will also remain in place.

Applying for a USDA Loan After a Foreclosure

Your waiting period to apply for a USDA loan after a foreclosure is also going to be 3 years. USDA loans would allow for 100% financing for homes located in rural areas. Read more about USDA loan requirements.

Applying for a Conventional Mortgage After a Foreclosure

A conventional mortgage is likely the hardest type of loan to get after a foreclosure especially since this type of mortgage has the longest waiting period of 7 years. Fannie Mae guidelines on foreclosures and mortgages in general are not friendly to individuals who have had a credit event or simply poor credit scores. This is why we are recommending a non-prime lender rather than a conventional lender.

Related Questions

When does the clock start ticking on the waiting period for an FHA loan?

The waiting period begins the day of your foreclosure and is measured up until an FHA case number is created for your file. That is usually the day you officially apply for the mortgage.

What are acceptable extenuating circumstances to reduce the waiting period after a foreclosure?

Extenuating circumstances are viewed as acceptable situations which prevented you from making mortgage payments on your prior home. This includes the death of a co-borrower, a job loss, a significant pay cut, being deployed by the military, or a serious medical or health issue which prevented you from making mortgage payments.

Is it hard to get a mortgage after a foreclosure?

Getting a mortgage after a foreclosure is much harder than after a bankruptcy. With a bankruptcy, many home owners still make their payments while foreclosures occur specifically because payments are not being made. As a result, the lenders feel there is an increased risk level when lending to someone who has a recent foreclosure.

What if I am in the process of getting foreclosed upon now?

If you received a foreclosure notice but the foreclosure sale has not occurred yet, then you do not officially have a foreclosure in your history. Although you likely have quite a few recent missed mortgage payments, you may be able to refinance now or sell before the foreclosure to buy a new home.

Can I get a mortgage after a foreclosure with a co-signer?

You can add a co-signer to your mortgage if you have a recent foreclosure. However, this will not reduce your waiting period because the requirements for that will still apply despite adding someone else to the loan. Lenders also will use the lowest credit score of the two borrowers. Therefore, the only benefit by adding a co-borrower would be the additional income they would bring to the loan application.

Related Articles

Applying for a Mortgage After a Bankruptcy

Applying for a Mortgage with Bad Credit

When Do You Have to Disclose Your Foreclosure?

Discussion Topics

Footnote:

Foreclosure Rates for the United States

As of September 2019, Realtytrac reported that 1 of every 2,767 homes was foreclosed upon. They also report the top 5 states for foreclosures are Delaware, Maryland, Illinois, New Jersey, and Connecticut.

We can help you to find a mortgage after foreclosure lender in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming