Home Loans for Federal Employees

If you are a federal or government employee, you may have an opportunity to purchase or refinance a home with some special home loan programs.

There are home loans for federal employees to purchase or refinance a home using down payment assistance programs or lender closing cost credits.

Get a Quote with No Credit Pull

What is a Federal Employee?

There are over 2 million federal or government employees in the United States. 10% of those employees work in or around the Washington DC area.

Federal employees work for a federal agency or branch. This is different than employees who may work at the state level of government.

You also have contractors who work for the federal government but are not officially federal employees.

Contact us here to see what special programs may be available for you

What are some Federal Jobs?

At the highest level, you have senior executive service jobs such as politicians, cabinet members or ambassadors. Next, you have the following branches where federal employees will work.

- Federal Judiciary

- Department of Agriculture

- Department of Commerce

- Department of Defense

- Department of Education

- Department of Energy

- Department of Health and Human Services

- Department of Homeland Security

- Department of Housing and Urban Development (HUD)

- Department of the Interior

- Department of Justice

- Department of Labor

- Department of State

- Department of Transportation

- Department of the Treasury

- Department of Veterans Affairs

The Department of Defense and the department of Veteran Affairs is the largest employer of all government branches. As you can imagine, there are many active military and those who support them and our veterans working every day.

Are there Special Home Loans for Federal Employees?

The only mortgage program that is available to past and present federal employees only is the VA loan. Although the Federal Government does not specifically offer home loans to non-military federal or government employees, there are programs that are available to help purchase a home or refinance

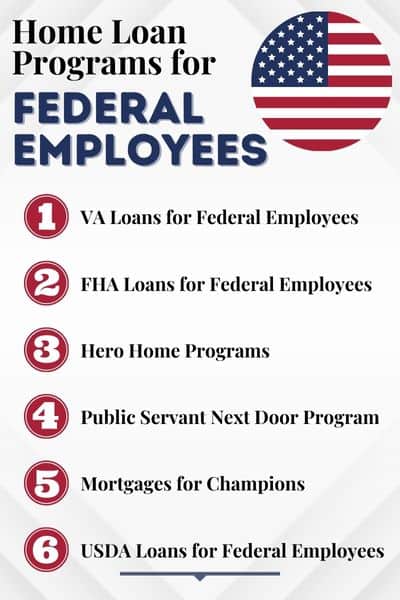

Home Loan Programs for Federal Employees

The following are some examples of home loan programs for Federal Employees. Some of these are also available to people who work in the private sector.

VA Loans for Federal Employees

The VA loan is the only mortgage that is available only to Federal Employees. The loan is offered by lenders, not offered by the Federal government, but the loan is backed by the government insuring it against default.

VA loans are available to veterans, active military and their spouses. Read more… [VA Loans]

FHA Loans for Federal Employees

The Federal Housing Administration (FHA) works with certain lenders to offer home loans that lower down payments, and the down payment could be as low as 3.5% of the loan.

Many individuals who have lower credit scores can still get an FHA Loan. These loans are not borrowed from the FHA directly, they are through the lenders who receive insurance from the FHA.

FHA loans may be the best option for a Federal Employee when you consider all of its benefits and ability to overlay down payment assistance.

Learn more in this article about FHA Loans.

Hero Home Programs

Hero Home Programs is an organization that offers federal employees (and government employees, state, county or city governments) specialized mortgage options. They assist buyers with several programs with finding grants or assistance.

The organization was founded about 20 years ago and has given more than $100 million to more than 56,000 individuals.

Public Servant Next Door Program

The Public Servant Next Door Program offers a government employee a housing grant that focuses on down payment assistance. Because this is a grant, it does not need to be paid back.

The Public Servant Next Door also offers preferred interest rates. On their website, you can input your information and the site will not initially check your credit but instead will have a program specialist contact you to discuss what options you may be eligible for.

Mortgages for Champions

Mortgages for Champions offers to pay for all fees and closing costs on a new home. The program boasts no application, processing, underwriting, or commitment fees. Keep in mind, this is likely in exchange for a higher rate.

Mortgage for Champions states that their home loan programs need little or no down payment, there are low rates, and the credit score criteria can be lower.

USDA Loans for Federal Employees

USDA loan assists people in rural and suburban areas. This is a government backed loan that you can get 0% down with and possibly get lower interest rates.

You will need to intend to purchase a home in a rural area and there are income guidelines and the home most be located in a USDA designated rural area. Read more.. [USDA Loans]

Although there might not be many federal employee geared home buying programs, that doesn’t mean a federal employee should rule out some of the more common home loan options.

How Federal Employees Can Get Approved for a Mortgage

Getting approved for a mortgage as a federal employee is really no different than what someone who works in the private sector would have to do.

Credit

As with all individuals wanting to purchase a new home, there are steps you need to take to ensure that you are in the best possible place to be approved.

Check your credit score! Although there are programs that will allow/work with a lower credit score, it is still important to work towards better credit.

Review your score and credit report for errors. If there are errors, you may need to dispute them which can take months. This should be done at the direction of a good loan officer.

Many lenders will want to see a credit score of at least 620. With some of the specialized loan programs, the rate is acceptable at 580 or even at a 500 score. However, the lender will base some of their approval decision upon what is actually on your report, not just the score.

Read more about [Bad Credit Mortgages]

Debt to Income

Another factor that lenders will look at is your Debt to Income (DTI) ratio. The debt that you owe, such as credit card payments, loans, and other bills should be about 30% or less than what your monthly income is. The reason that lenders look at this is because they want to ensure that you can actually pay back the loan.

Work History

Most loan programs require a two year work history. They look for a full two year history of working full time with no gaps in employment. If there are gaps, what was the reason? Small gaps in employment are okay but you will need to have been back to work for at least three months.

Documentation

Lenders will ask for 30 days of pay stubs, last two months bank statements and the last two years W2s and Tax Returns. If you have W2s but have not filed your taxes for the past two years, then you still may qualify for an FHA loan.

These are some of the steps every borrower needs to consider, and it is no different for federal employees looking at special programs.

The main take away for a federal employee looking to purchase a home is to do your research and reach out to see what programs are available. Work on your credit ahead of time and have a clear idea of where you stand. This will assist you in knowing what direction you need to take.

Do Federal Employees Get Special Mortgage Rates?

Although lenders may advertise special rates or programs for federal employees, there is nothing in place to provide different interest rates for them at the government level.

Federal Employee Down Payment Assistance

The US government does not provide any down payment assistance for all Federal Employees. There is a program from USA.gov which provides down payment assistance for first time home buyers. It is not specific to Federal or Government employees