How are Mortgage Rates Determined?

Do you know how mortgage rates are determined? Many borrowers wonder why rates vary from one lender to the next but also why small details about their loan application may change the rate.

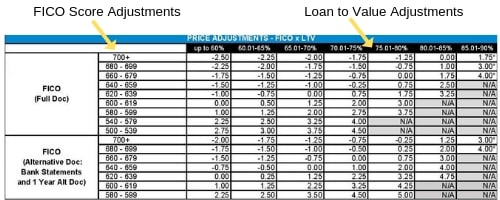

Lenders have a full matrix of factors that help decide what your final mortgage rate will be. The larger the down payment and the higher your credit score, the better your rate will be.

Mortgage rates have a base rate that is influenced by the federal funds rate and the bond market. As bond yields increase, so do the mortgage rates. As the yields decline, so do the mortgage rates.

Next, rates are also influenced by the federal funds rate which is set by the Fed and that determines the cost at which lending institutions lend money to one another. This plus the bond market swings are where the base mortgage rates come from and then adjustments as outlined below are made from there by the lender depending upon your personal scenario.

Top Factors that Impact How Mortgage Rates are Determined

Credit Score – Credit scores are one of the primary factors in determining what your rate will be or whether  you will get approved for a mortgage at all. Many borrowers neglect their credit and when it comes time to apply for a mortgage, they find out that it may be too late to make improvements quickly.

you will get approved for a mortgage at all. Many borrowers neglect their credit and when it comes time to apply for a mortgage, they find out that it may be too late to make improvements quickly.

From a mortgage rate perspective, the best rate is 720 and any score greater than that will not get you a better rate. If you would like to give yourself the best chance to get a low rate, then read about how to improve your credit score.

Down Payment – Loan to Value Ratio – The down payment loan to value ratio has a large impact on your rate as well. Combined with your credit score, those two factors probably are the most important. The more you put down, the lower your score will be. You can expect to pay a much higher rate if you are putting a small amount down.

There only exception to this are FHA loans. Although you will likely still get a competitive rate even though you are only putting down 3.5%. Read our article on FHA loans to learn more.

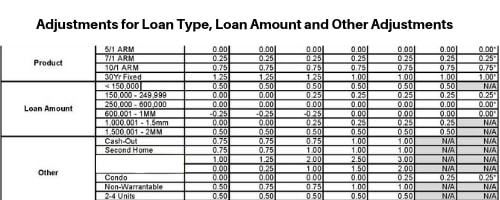

Loan Program – There are differences in rates between loan programs as well. The conventional loans and government loans such as FHA, USDA and VA all have different rate parameters. So, while you may be looking closely at the down payment requirements, you should also pay close attention to the rates for each program. Then, do the math over time to see which one will cost more in total payments.

Loan Term – Most borrowers immediately go for the 30 year fixed program. However, that term will likely come with the highest rate. If you are able, take a close look at the 15 yr fixed because it will have a lower rate despite the higher payments.

Adjustable rate loans such as a 5 year arm or 7 year arm will likely have rates that are a bit lower than a 30 year fixed. If you do not plan to be in the home long term, then you should seriously consider an adjustable rate mortgage program.

Ability to Document Income – A very common problem today is a borrower’s ability to document their income. This is usually something that self-employed borrowers deal with. They are showing a low net income on their tax returns which makes it difficult to qualify. Read our article on mortgages for self employed borrowers.

Self employed borrowers will likely go for a bank statement loan which will often come with a rate adjustment that is up to 1.5% higher than a loan where you can document your income.

The sample rate chart below is just an example and is not real but it is typical, and it gives you an idea as to how the factors above can impact rate adjustments.

Other Factors That May Impact How Mortgage Rates are Determined

Loan Amount – Many lenders have adjustments for the loan amount. If the loan is very small, they may increase the rate a bit to compensate for the loan amount. From their perspective, the work required to process and service your loan is the same regardless as to the loan size. So, slightly higher rates for very small loan amounts are not uncommon.

At the same time, some lenders may also add an adjustment for very large loan amounts to offset some of their risk. Jumbo loans typically have higher rates than conventional and super jumbo loans may even be higher.

Property Type – The best rate will be for a single family home and possibly a condo. However, some lenders add on a small rate adjustment for condos. In fact, immediately after the housing bubble in 2008, many lenders increased their condo rates in Florida significantly or completely stopped providing loans for condos.

Multi family buildings may come with a rate adjustment and mobile homes almost always have a higher rate than a home without wheels.

Property Use – Your best deal is going to be on a home that is being used as your primary residence. Second homes may have a slight rate adjustment but not always. Investment or rental properties almost always will have a higher rate adjustment.

The chart below outlines some of these other factors which may impact how mortgage rates are determined. Similar to the chart above, it is just an example and does not reflect rate adjustments from any particular lender.

How Can I Get the Lowest Mortgage Rate?

How can I get the lowest mortgage rate? This is the question that you should be asking. Too many people call a lender and ask, “what are your rates?” Now that you had a chance to see all of the factors that impact your mortgage rate, you can see how a lender cannot possibly give you a rate quote without asking you a lot of questions to build a loan profile for you.

Final Recap

Now that you know how mortgage rates are determined, you should take the time to put yourself in the best position to take advantage of the best rate possible. This means, getting your credit score to over 720 and put as much down as you can.

Related Articles

How to Find the Lowest Mortgage Rate

How to Find a Good Loan Officer

Top 25 Questions to Ask a Lender

Discussion Topics