Can You Get a Mortgage with a Car Loan?

Home buyers often find themselves falling short of qualifying for the purchase of their dream home because they have too many other monthly obligations driving up their debt to income ratio. One of the big ticket items that contribute to this problem is the car loan and the large monthly car payment.

It is possible to qualify for a mortgage with a car loan despite having a large monthly car payment. However, every $100 in car payments reduces your home buying power by about $25,000. Working with your lender well in advance will help put you in the best position to find a mortgage to purchase a home.

Getting a Mortgage with a Car Loan

Applying for a mortgage with a car payment on your credit report may create some challenges for you if you are trying to purchase a home. Most people do not realize how much a car payment reduces your home buying power.

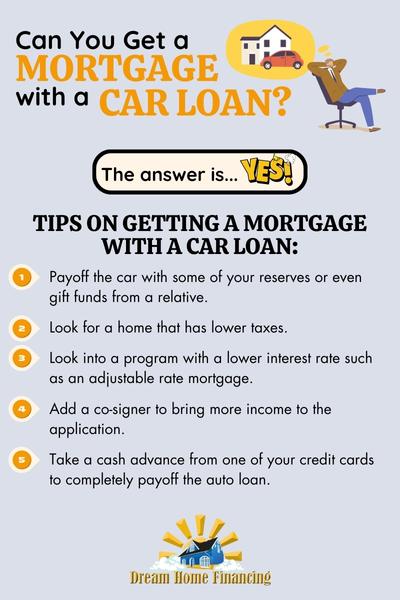

A sizeable car payment is going to drive up your DTI (debt to income ratio) reducing how much you are able to qualify for. If you already have the car and you need to qualify today, you should work with your lender to help reduce your DTI by trying one or more of the following:

- Payoff the car with some of your reserves or even gift funds from a relative.

- Look for a home that has lower taxes. This will help offset the impact of the car payment.

- Look into a program with a lower interest rate such as an adjustable rate mortgage. This will help you to qualify for a larger mortgage amount.

- Add a co-signer to bring more income to the application.

- Take a cash advance from one of your credit cards to completely payoff the auto loan. This is not optimal and not recommended because the interest rate on credit cards is much higher than for an auto loan. You should verify with your credit card company what your minimum monthly payment would be before moving ahead with this. Once again, this is something to do when there are no other alternatives.

These are just a few tactics that your lender will help you with. If you would like to speak with a lender now to see if you qualify, then complete this short form and someone will reach out to you.

How a Car Payment Impacts How Much Home You Can Afford

The debt to income ratio calculations are impacted most by the monthly debt or payments that appear on your credit report. For every dollar of debt/payment you have on your credit report, you need almost three times that amount in additional income to offset it so that it has no impact on your mortgage qualification.

The DTI calculation is not about whether you have enough money to actually make a payment. It is a guardrail to make sure you are not spending more than about 43% of your monthly gross income on all of your large monthly expenses.

This is how car payments impact how much home you can afford:

| Monthly Car Payment | Home Price Reduction |

| $100 | $25,000 |

| $200 | $45,000 |

| $300 | $70,000 |

| $400 | $90,000 |

| $500 | $115,000 |

| $600 | $135,000 |

If your DTI is high and the car loan is making it difficult to qualify for a mortgage, then READ [article on how to qualify with a high debt to income ratio]

Is it Bad to Buy a Car Before Buying a House?

It is not optimal to buy a car right before buying a home. The car payment will negatively impact your ability to qualify for the mortgage you need. The recommendation is to wait until after you purchase the home.

We suggest speaking with a loan officer well in advance and before you purchase a car. They will be able to tell you what car payment would work while also trying to qualify for a mortgage.

Will Having a Car Effect Getting a Mortgage?

Owning a car does not effect getting a mortgage but having a large car payment absolutely will reduce your buying power and hinder your ability to qualify for a mortgage.

How Long After Buying a Car Can I Buy a House?

There is no waiting period to purchase a home after buying a car. If you have a car payment on your credit report, then it will used in your DTI calculation regardless of how long ago you purchased the car. The only exception is if you have less than 10 more payments remaining on your car loan, the lender may exclude that payment from your DTI calculation.

What if I have Just a few Car Payments Remaining?

If you have only a few car payments remaining, it may be possible to have that payment excluded from your DTI calculation. The FHA guidelines do allow lenders to use their discretion when making exceptions. In this scenario, your other option is to ask a friend or relative to payoff the balance for you while you make the final payments to that individual.

Can I get a Car Loan and a House at the same time?

You can get a car loan and a house at the same time. However, it is best to purchase the home first and then get the car. We suggest you do not allow the car dealer to pull your credit until after you close on your mortgage. Then, you can go from the closing on your home right to the auto dealer to purchase your car.

Virtually anyone can qualify for an auto loan today and you can be assured that if you were just approved for a mortgage with more stringent guidelines, then you will have no problem qualifying for an auto loan AFTER buying your home.