Getting a Mortgage Without Two Years Work History

For most lenders, one of the first requirements is a consistent two year work history or two years in your business for the self employed borrowers. If you do not have two years work history and have been looking for a mortgage, I am sure you are finding there are few lenders who can help you.

Why Do Lenders Typically Require a Two Year Work History?

The work history requirement is driven by the Fannie Mae and Freddie Mac guidelines to qualify for a conventional loan. Traditional lenders like the bank you may find in your neighborhood are following those guidelines.

Can I Get a Mortgage Without Two Years Work History?

If you do not have a full two years work history, you can get a mortgage to purchase your dream home. However, it will be through a program that is non traditional. You will need to prove that you are employed and have a steady flow of income. Let us help to match you with a lender who will approve a mortgage without two years work history.

Inquire About a Mortgage Without Two Years Work History

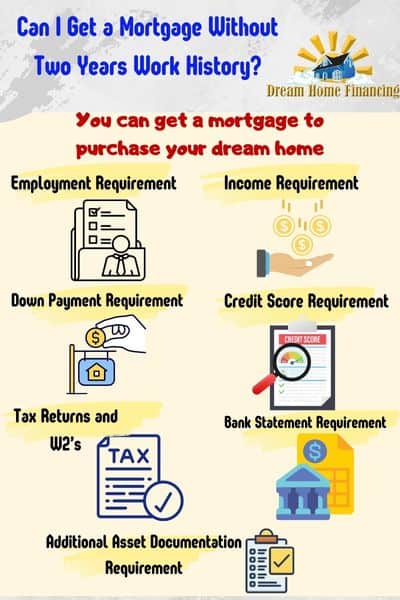

Requirements to Get a Mortgage Without Two Years Work History

Below are the requirements that you will have to meet when applying for a mortgage without a two year work history:

- Employment Requirement– You will need to provide proof that you are employed by providing a letter from your employer or some other documentation that proves you are employed. If you are self employed, then a business listing, a license or a letter from your accountant showing that you indeed are self employed. Although the lender we work with will approve your loan with less than a two year work history, one month may not be enough. We will have to submit your loan scenario to the lender along with other compensating factors for approval.

- Income Requirement – For W2 wage earners, you will need to provide at least one month’s pay stubs and qualify using your gross income. For self employed borrowers, you will need to supply bank statements showing deposits into your accounts.

- Down Payment Requirement – Depending upon your credit score and ability to document your income, the minimum down payment requirement will be 15%. The only way to truly know is to submit your scenario to us and you can review with the lender.

- Credit Score Requirement – The minimum credit score requirement can be as low as 500. However, a score that low will have a significant impact on you down payment requirement and rate.

- Tax Returns and W2’s – W2 wage earners will need to provide tax returns and W2s if they are available. Self employed borrowers may be asked to provide a P&L statement from an accountant.

- Bank Statement Requirement – For W2 wage earners, you will need to provide the last 2 months’ bank statements to prove that you have the down payment amount and any reserve requirements. For self employed, you will be asked to provide up to a years worth of bank statements if you have been in business for that long.

- Additional Asset Documentation Requirement – You may be asked to provide any other assets which can help with your approval. This could be brokerage statements, other real estate, and retirement accounts. You should be willing to provide this documentation since it helps to strengthen your mortgage application.

Buying a House with Gaps in employment

Most lenders do not allow for you to have gaps in employment without an acceptable written explanation. The gap could be created by a job loss and the time it took to find a new job. It could be due to an illness or having to take care of a family member.

In some instances, the gap was created after a new born child came into the world. Often times, a loan application would get rejected due to the gap in employment. We are able to overcome this problem and still get your loan application approved.

If you have a two year work history prior to when the gap in employment began, you may still qualify for a mortgage. We will need for you to have been at your current job for 30-60 days to re-establish yourself. You should be prepared to provide at least 30 days of pay stubs from your new job.

It would be helpful if your new job was in the same field and it must be a W2 job, not a self employed business or 1099 job.

Compensating factors

A compensating factor is when you have other areas of your application which provide strength and offset an area of concern or risk to the lender. In this case, the risk or concern would be applying for a mortgage without two years work history. Some examples of compensating factors are a large down payment, high credit scores, and a large amount of reserves in your bank account. Lenders will take these positive compensating factors into consideration when reviewing your application.

Bankruptcy or foreclosures

If you have a recent bankruptcy or foreclosure, you can still get a mortgage without two years work history. Even if you filed for bankruptcy yesterday we can help. However, your down payment requirement may be higher and so will your rate. It can be done. Government programs such as FHA and also Fannie Mae approved conventional mortgages will not permit the approval of your loan with a bankruptcy or foreclosure within the past two years.

What Rates Can You Expect Without Two Years Work History?

The lenders who will approve a mortgage without two years work history will likely have a small rate adjustment in exchange for the risk they are taking with your shortened work history. The rate will likely be slightly higher than what you would expect if you have two years work history. However, the rate will still be competitive and will help to get you into your dream home.

What Fees Can You Expect Without Two Years Work History?

The fees associated with this type of mortgage will be similar to that of a conventional loan. Each lender will provide you with a good faith estimate within 24 hours of applying for the mortgage. In general, the fees are standard and customary.

How long do you have to be at a job to get a mortgage?

You can get a mortgage after being at a new job for just 30 days. The lender will ask you to provide your pay stubs for the past month to verify your income in addition to a letter from your new employer.

Keep in mind that the lender will still look for you to have a two year combined work history. It is okay to have a short gap between the two jobs.

Can I Get a Mortgage with No Job But Large Deposit?

If you have no job, there are just a couple of mortgage programs available to you but you will need a large deposit or down payment. In addition to the deposit, your credit scores will be the other determining factor of whether you will qualify for the mortgage.

The deposit or down payment needed without having a job will start at 15%-20% down. If you have a deposit of 25% or more, you will have the most mortgage options available to you.

The type of loan which will allow you to qualify without a job is one offered by non-QM lenders. You should expect the interest rates to be slightly higher than what you would be offered for a conventional or FHA loan.

Can You Get a Mortgage Without a Job?

Most lenders cannot approve a mortgage for a primary residence without a job. However, there is a niche program similar to a no doc loan that will not verify employment. You can expect both the down payment and the rate to be much higher than a conventional loan due to the added risk for the lender.

If you are buying an investment property, the type of loan needed never requires a job. The lender will evaluate the loan application based upon the investment opportunity and your credit scores.

Conclusion

If you do not have a two year work history, this is the perfect loan option for you. Lender guidelines change constantly and we are doing our best to stay on top of it all for you. Please contact us so we can help you with your loan scenario.

Other Related Questions

Is There a Pre-Payment Penalty?

There is no pre-payment penalty with a mortgage without two years work history. Today, pre-payment penalties exist in a few instances but it is rare and usually tied to investment property loans.

Can I get an FHA mortgage without two years work history?

The guidelines for FHA loans require you to have two years work history. There are no exceptions.

Related Articles

Getting a Mortgage with a New Job

How to find a good loan officer

Should I use the realtor preferred lender?

Discussion Topics