VA Funding Fee

What is the VA Funding Fee?

The VA funding fee is an upfront payment made by the borrower on every eligible VA loan. This fee in lieu of a down payment requirement so funds can be returned to the VA to help offset the costs needed to insure the loans.

How is the VA Funding Fee Calculated?

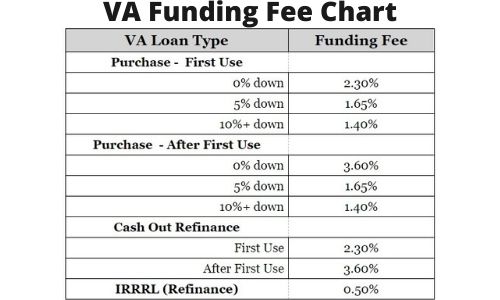

The funding fee follows a standard calculation that is determined by the VA and one that every lender must follow. The funding fee calculation will vary based upon whether it is a purchase, a refinance, a cash out refinance, and also whether this is the first time you are applying for a VA loan.

This VA funding fee chart details how the fee is calculated today:

| VA Loan Type | Funding Fee |

| Purchase – First Use | |

| 0% down | 2.30% |

| 5% down | 1.65% |

| 10%+ down | 1.40% |

| Purchase – After First Use | |

| 0% down | 3.60% |

| 5% down | 1.65% |

| 10%+ down | 1.40% |

| Cash Out Refinance | |

| First Use | 2.30% |

| After First Use | 3.60% |

| IRRRL (Refinance) | 0.50% |

4 VA Funding Fee Exemptions

There are four VA funding fee exemptions that you potentially could be eligible for. Your VA lender would submit the exemption request on your behalf if you meet one of the four exemption requirements:

- Veterans who are receiving a service related disability benefit – if you have a disability claim pending when you close on your loan, you are required to pay the funding fee. If your disability claim is approved after you close on the loan, you will need to ask the VA for a refund

- Veterans on active duty – If you are still serving in the military, no funding fee will be required.

- Purple heart recipients – As a “thank you” for your bravery, purple heart recipients are not required to pay a funding fee.

- Surviving spouses of Veterans – Surviving spouses of veterans who have served this country also are exempt from the funding fee.

Only the VA can decide whether you are eligible for an exemption. Therefore, your lender would need to request this exemption for you. If your lender informs you that your request for an exemption has been denied, it is the VA that has made that decision.

If two veterans are applying for the mortgage and one is exempt, the funding fee is cut in half. However, if the exempt veteran is not contributing entitlement, then the full funding fee must be paid.

Click to speak with a VA lender who can help with your VA loan and a possible funding fee exemption

How to Reduce the VA Funding Fee

The best way to reduce the VA funding fee is to put money down on the purchase. The larger the down payment the lower the funding fee will be.

Another way to reduce your out of pocket on the funding fee is to have the seller cover this for you during the contract negotiations. It is very common for sellers to cover some of all of the buyer’s closing costs so use this to your advantage.

Rolling the Funding Fee into The Loan

The VA funding fee can be rolled into the loan so you do not have to pay for it out of pocket at closing. Keep in mind, this means you are financing this fee and paying interest on it for as long as you have a mortgage on the home.

Assuming a VA loan

VA loans can be assumed, but the new home buyer assuming the mortgage will need to pay a half percent funding fee to assume that mortgage. The new home buyer or borrower must also meet all of the eligibility criteria for a VA loan in addition to the income and credit requirements.

Related Articles

VA Loan with Bad Credit Requirements – see what it will take to qualify for a VA loan

VA vs Conventional Loans – If you do have a down payment, then weigh the differences between a VA and conventional loan

Verification of VA Benefits – Use this form to help verify that you are entitled to receive VA benefits.

Bad Credit Mortgage Lenders – This article discusses the mortgage and lender options if you have bad credit.