Mortgages for Contractors and 1099 Employees

Independent contractors and 1099 employees often cannot qualify for conventional or government loans. However, there are non-traditional mortgage options that can help independent contractors to secure a mortgage approval to purchase a home.

Challenges for Independent Contractors When Applying for a Mortgage

Independent contractors and 1099 workers have the benefit of legally writing off all business related expenses from their taxes. This results in a much lower reported income or even a loss shown on the tax returns making it difficult to qualify for a mortgage.

Conventional and government mortgages such as FHA, VA and USDA all require contractors to use the reported income after those write offs. Therefore, independent contractors and 1099 employees find themselves searching for alternative mortgage solutions.

Contractors most commonly impacted by this challenge are builders, carpenters, masons, electricians, plumbers, restaurant owners, consultants, salon owners, landscapers, real estate agents, farmers, and painters. Or course there are many more professions that are impacted but these are the most common.

How Independent Contractors Get Mortgages

Contractors can still apply for a conventional or government mortgage if they are able to qualify using their tax returns. The down payment options and interest rates will be lower if they can. However, most independent contractors or 1099 employees find themselves applying for a bank statement mortgage.

Bank Statement Mortgage

Bank statement mortgages were created to assist self employed independent contractors and 1099 employees to qualify for a mortgage. While there are regulations requiring lenders to make sure borrowers have the ability to repay the loan, this mortgage program was created as an alternative to help them to qualify.

This mortgage program essentially asks contractors to provide bank statements proving there is a flow of money (deposits) coming into their business or personal banking accounts. Lenders will use a portion of these deposits as their monthly income on the loan application without requiring tax returns.

Click to speak to a lender who specializes in working with contractors

How to Calculate Self Employed Income for a Mortgage

Traditionally, lenders will require self employed individuals to use the average net income or loss over the past two years. Many contractors attempt to hold back on their tax write offs for two years to their reported income is higher helping them to qualify. We are not giving tax advice here so if this is something you are considering, then please consult your accountant.

Mortgages for 1099 Employees

1099 employees have the same tax benefits when it comes to writing off expenses, but then also face the same challenges when applying for a mortgage. For 1099 employees applying and qualifying for a mortgage is the same as someone who owns their own business. The best option for a 1099 employee who reports a low net income is the bank statement loan.

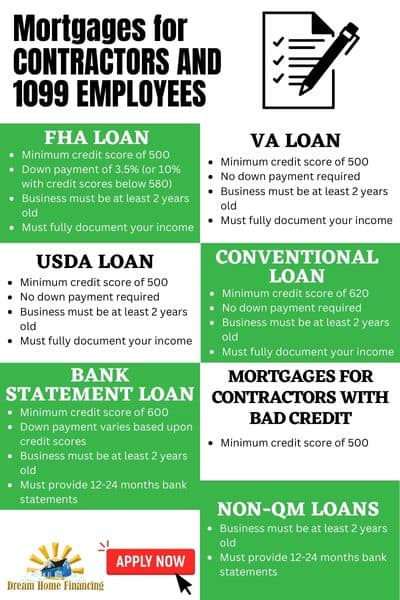

7 Best Mortgages for Contractors

The following mortgage programs are available to contractors and 1088 employees. Depending upon your ability to document your income some or all of these mortgage options may not apply to you.

FHA Loans – FHA loans allow for a small down payment and credit scores as low as 500. Contractors will need to provide tax returns for two years and qualify using the income after write offs. Some lenders will allow for a DTI as high as 50% or more so it may make sense to see if you can qualify for an FHA loan.

-

- Minimum credit score of 500

- Down payment of 3.5% (or 10% with credit scores below 580)

- Business must be at least 2 years old

- Must fully document your income

Read our full article on FHA loans so you can fully understand the program details and requirements.

VA Mortgage – VA loans are for veterans, active military and their spouses. This mortgage program allows for poor credit, has no down payment requirement, and requires the contractor to provide tax returns.

-

- Minimum credit score of 500

- No down payment required

- Business must be at least 2 years old

- Must fully document your income

Read our full article on VA mortgages to see what is required and then let us connect you with a VA lender who can help

USDA Mortgage – USDA mortgage loans are available to all US citizens who can qualify for the program and if the property address falls within a USDA designated rural area. Contractors can purchase a home in a rural area with no down payment. However, the property cannot be used as a farm.

-

- Minimum credit score of 500

- No down payment required

- Business must be at least 2 years old

- Must fully document your income

Read our article on USDA loans and there you can find link to the USDA property eligibility look up tool.

Conventional Mortgage – Conventional mortgages are the most popular mortgage program. They allow for down payments as small as 5% but most contractors and 1099 employees have difficulty qualifying for them. The minimum credit score is higher than the other programs too.

-

- Minimum credit score of 620

- No down payment required

- Business must be at least 2 years old

- Must fully document your income

Read our article on conventional mortgages to understand what is required.

Bank Statement Mortgage – This is the best program for contractors because it allows them the opportunity to qualify based upon the money they bring in and not based upon the net income on their tax returns.

-

- Minimum credit score of 600

- Down payment varies based upon credit scores

- Business must be at least 2 years old

- Must provide 12-24 months bank statements

Read our full article on bank statement mortgages to see if you qualify

Mortgages for Contractors with Bad Credit

If you are a contractor or a 1099 employee with bad credit, there are a few programs that may help you. First, the FHA guidelines permit contractors to apply with credit scores as low as 500. There are also sub-prime lenders who will allow for lower credit scores too.

Read our article about bad credit mortgages to see what options may be available to you.

Lenders who offer Mortgages for Contractors

Virtually every lender will offer conventional and government loans such as FHA, VA and USDA. We mentioned earlier that these programs are available to contractors although it will be difficult for them to qualify due to all of the tax deductions and write offs.

Lenders who offer the customized bank statement mortgage are not very common. These are considered to be non-QM mortgages and a small group of lenders specialize in this area. We work with many of the lenders in the industry who offer these programs. Each of them will have different requirements as well as different state licensing. Let us help you to find the best lender to help with your unique situation. Start by completing this short loan scenario form and we will get back to you quickly.

What Income to mortgage companies look at for self-employed contractors?

Underwriters will look for a contractor to be in business for at least two years. They will also verify that the mortgage can be repaid by analyzing the last 12-24 months bank statements.

Do mortgage lenders look at gross or net income for self-employed?

When a lender reviews your mortgage application, they will look at the net income after our write offs to determine whether you qualify. This is the process for conventional, FHA, VA and USDA loans. Bank statement loans will look at a percentage of your average monthly bank deposits.

Related Articles

Self Employed Mortgages – This article discusses the mortgage options for self employed individuals in greater detail.

The 10 Best Self Employed Jobs – See what the may interest you if you are considering becoming an independent contractor

Portfolio Loans – Lenders who offer these creative loan programs keep them in their investment portfolio.

Discussion Topics