Non Warrantable Condo Loans

Purchasing a condo is a bit different than buying a single family home. There are associations to deal with, common areas and lenders often impose different guidelines for condos.

Lenders not only need to feel comfortable financing the unit you plan to purchase, but they are also concerned with the condition and financial stability of the entire condo complex. When the condominium does not meet all of the minimum lending standards, it is considered to be non-warrantable.

In some instances, lenders prefer not to finance non warrantable condos. In this article, we will review the differences between a warrantable vs non warrantable condo and where you can get financing.

What is a Non Warrantable Condo?

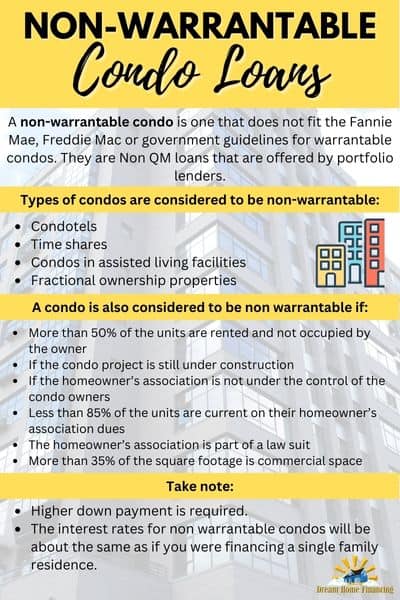

A non-warrantable condo is one that does not fit the Fannie Mae, Freddie Mac or government guidelines for warrantable condos. They are Non QM loans that are offered by portfolio lenders.

In general, the following types of condos are considered to be non-warrantable:

- Condotels

- Time shares

- Condos in assisted living facilities

- Fractional ownership properties

A condo is also considered to be non warrantable if at least one of the following is true about the condominium in question:

- More than 50% of the units are rented and not occupied by the owner

- If the condo project is still under construction

- If the homeowner’s association is not under the control of the condo owners

- Less than 85% of the units are current on their homeowner’s association dues

- The homeowner’s association is part of a law suit

- More than 35% of the square footage is commercial space

If the condo you are looking at falls into any one of these categories, then you may need to speak with a non warrantable condo lender. Meanwhile you can read the Fannie Mae description of a non warrantable condo

Non Warrantable Condo Loan Programs

If you are purchasing a warrantable condo, then you can get a conventional mortgage, an FHA, or any other government loan. However, if the condo is non warrantable, then those loan programs will not apply and you will instead need to find a Non QM (non qualified) mortgage.

A non qualified mortgage is one that is offered by special lenders who offer niche products to help solve for difficult lending scenarios. These would include financing for bad credit, mortgages after a bankruptcy, self employed mortgages, and even a scenario where the subject property is a non warrantable condo.

FHA Loans for Non Warrantable Condos

The FHA guidelines for buying condos stipulate that at least 51% of the condo units must be owner occupied. If you have your heart set on financing your condo with an FHA loan, it would be good to speak with an FHA lender before making an offer.

Non Warrantable Condo Lenders

Non warrantable condo lenders are really Non-QM Lenders or some instances Portfolio Lenders. These lenders are typically not found in your neighborhood. Instead, they are lenders who specialize in niche mortgage programs that can help to finance a non warrantable condo. Below is a short list of just a few lenders who offer non warrantable condo loans.

Keep in mind these are just a few of the lenders who offer non warrantable condo loans. Each of them have different guidelines and down payment requirements. We also work with other lenders who may be better suited for your needs. Complete our loan scenario form to get a quote without pulling a credit report.

Non warrantable condo lenders will allow you to qualify using traditional income documentation, or using bank statements if you are self employed.

Non Warrantable Condo Rates

The interest rates for non warrantable condos will be about the same as if you were financing a single family residence. Keep in mind that some lenders do have a very small rate adjustment for non warrantable condos. However, that adjustment would be very small and should not prevent you from moving ahead with your non warrantable condo purchase.

What you may find is the down payment for a non warrantable condo will be higher. A down payment of 3.5% for example will not be available unless the condo is warrantable.

Non Warrantable Condo Refinances

Lenders also offer refinances and cash out refinances for non warrantable condos. You may find the loan to value ratio up to 90% on rate and term refinances, and up to 85% for cash out refinances.

You will have the ability to use the funds for debt consolidation, remodeling or any other purpose. If the condo is an investment, then you can find investor lenders who do not have rules regarding non warrantable condos.

How to find out if a condo is non warrantable

The best way to determine whether a condo is warrantable or non warrantable is to ask the listing real estate agent. You also can try this HUD condo lookup site to see whether the condo is on the approved list for warrantable condos. If it does not show up there, then you should continue with speaking with a realtor.

Should I Buy a Non Warrantable Condo?

There is nothing wrong with buying a non warrantable condo if it meets your personal needs, is considered to be a good investment, and you can meet the lender’s requirements.

Many people purchase a condo that is warrantable, but over time the condo eventually becomes a non warrantable condo complex. This can happen if investors begin purchasing some of the condos in the building. This should not change your outlook on whether you should buy a non warrantable condo.

Non Warrantable Condos – Frequently Asked Questions

Is buying a non warrantable condo risky?

If financing for non warrantable condos becomes scarce, then it could drive the prices of those condos down. Although that is highly unlikely, there is a moderate amount of risk tied to that. However, if you plan to live in the condo for a while, then the value will eventually return.

Are there jumbo non warrantable condo loans?

Non warrantable condo loans are available in jumbo sizes up to $2 million depending upon the lender.

Do I need an inspection for a non warrantable condo?

You really should get a home inspection for any purchase regardless as to whether it is a single family residence, condo, or non-warrantable condo. In fact, if you plan to purchase a home using an FHA loan, then an inspection is required.

Can I Buy a Non-Warrantable Condo with an FHA loan?

Non warrantable condos are not eligible for FHA financing. Therefore, you will need to speak with a lender who specializes in non warrantable condo loans.

Why are there so many non-warrantable condos in Florida?

Florida has many non-warrantable condos because real estate investors own many of the units. When more than half of the units in a condo complex are not owner occupied, it becomes a non-warrantable condo. This is very common in Florida.

Related Articles

The Best Mortgage Program for First Time Home Buyers

Top 25 Questions to Ask a Lender

Questions to Ask When Buying a Condo

We are able to help you to find a non warrantable condo lender in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming