Non-Bank Mortgage Lenders

Non bank mortgage lenders emerged and have become major players in the lending industry over the past 20 years. They have special niche mortgage programs that traditional banks do not offer. These mortgages serve to help borrowers who are self employed, have bad credit, have recent bankruptcies or foreclosures, and even those who are not US citizens. Today, non bank lenders originate over 50% of all new mortgages.

What is a non bank mortgage lender?

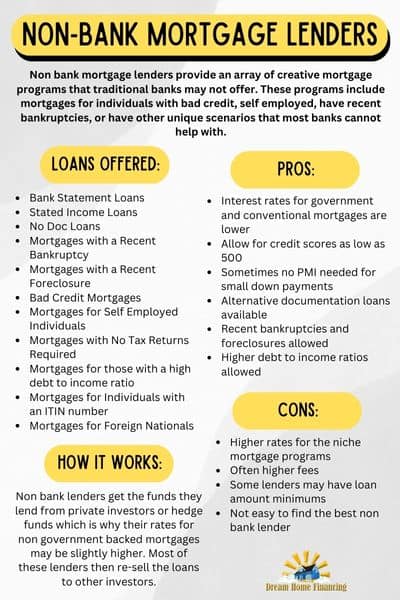

Non bank mortgage lenders provide an array of creative mortgage programs that traditional banks may not offer. These programs include mortgages for individuals with bad credit, self employed, have recent bankruptcies, or have other unique scenarios that most banks cannot help with.

Providing mortgages to consumers is the primary service that non bank lenders provide while traditional banks may be more focused on other aspects of their businesses such as credit cards and investments.

How do Non Bank Mortgage Lenders Work?

Non Bank Mortgage lenders are approved by the federal government to issue mortgages in the United States. They are monitored by the Consumer Financial Protection Bureau as directed by the Dodd-Frank Act.

Non bank lenders get the funds they lend from private investors or hedge funds which is why their rates for non government backed mortgages may be slightly higher. Most of these lenders then re-sell the loans to other investors.

List of Non Bank Mortgage Lenders

These are just a few examples of some non bank mortgage lenders that you may have seen advertised. We are not endorsing these lenders and in fact we work with others who may be more suitable for your specific situation. We recommend contacting us here and we can help determine which lender is best for you.

- Loan Depot

- Quicken Loans

- Angel Oak Mortgage

- Citadel Servicing

- Carrington Mortgage

- First National Bank of America

- PennyMac Loan Services

Click here for a free consultation with no credit inquiry

What Types of Mortgages do Non Bank Lenders Offer?

Non bank lenders will often offer some of the traditional programs such as FHA, VA and conventional loans. Those mortgages are insured by the government or Fannie Mae and therefore the rates will be equal to or less than what you may get from a big bank. However, the non bank lenders also offer niche mortgage products as indicated below:

- Bank Statement Loans

- Stated Income Loans

- No Doc Loans

- Mortgages with a Recent Bankruptcy

- Mortgages with a Recent Foreclosure

- Bad Credit Mortgages

- Mortgages for Self Employed Individuals

- Mortgages with No Tax Returns Required

- Mortgages for those with a high debt to income ratio

- Mortgages for Individuals with an ITIN number

- Mortgages for Foreign Nationals

These are just a few examples and not all lenders offer these programs. You can expect the rates for these mortgages to be a bit higher than a conventional loan from a local bank due to the increased risk.

Pros and Cons of Non Bank Lenders

Pros

- Interest rates for government and conventional mortgages are lower

- Allow for credit scores as low as 500

- Sometimes no PMI needed for small down payments

- Alternative documentation loans available

- Recent bankruptcies and foreclosures allowed

- Higher debt to income ratios allowed

Cons

- Higher rates for the niche mortgage programs

- Often higher fees

- Some lenders may have loan amount minimums

- Not easy to find the best non bank lender

Carefully consider these pros and cons and then have a discussion with a non bank lender to see if their programs and rates are best for you.

History of Non Bank Lenders

Non bank lenders became popular in the late 90’s when some of the alternative mortgage programs began to surface. Lenders such as Indy Mac began offering no documentation loans with little to no down payment. Other lenders provided loans with negative amortization where the loan balance would increase every month.

These mortgages were very risky and eventually were partly responsible for the mortgage or housing crisis in 2008. Lenders such as Indy Mac and Countrywide went out of business when many of the homes began to go into foreclosure.

Soon after, other non bank lenders were born but they learned from the mistakes of the past and offered niche mortgage programs that also mitigated some of the risk.

Related Questions

Where do non bank lenders get their money?

Non bank lenders are financed by private investors for their portfolio mortgages.

What Rates to non bank lenders offer?

Non bank lender will have very competitive rates when it comes to FHA, VA and conventional mortgages. However, you can expect the rate to be slightly higher for the niche programs they offer.

Why are non bank lenders better than big banks?

Non bank mortgage lenders are financial institutions that focus solely on the mortgage lending business. The do not offer checking and savings account services and most of them also do not offer credit cards. The large banks have gotten a reputation for not caring about their mortgage customers. Many consumers actually run to the non bank lenders after a bad experience with a large bank.

Customer service is just one reason why non bank lenders are better. The most important thing is they offer loan programs that big banks don’t offer. The larger banks only want to finance borrowers with the best credit. Unfortunately, nobody is perfect and as a result many people cannot qualify for a mortgage with a big bank.

Do non bank lenders offer FHA loans?

Non bank lenders do often offer FHA and other government loan programs. As a result, they have a larger portfolio of mortgage products than the big banks.

Related Articles

Mortgage broker vs Small Lender vs Big banks

How to Find a Good Loan Officer

Should I Use the Realtor Preferred Lender?